Your company is a separate entity from your personal life. Even though you might have used your own assets to start a business, it is crucial that you set a clear border between your business and personal financing, even throughout your business’s early stages. This article lists key expert tips for maintaining or stopping your funds out of commingling.

Here are 25 tips to keep personal and business expenses separate:

1. Create a Separate Entity for Your Organization

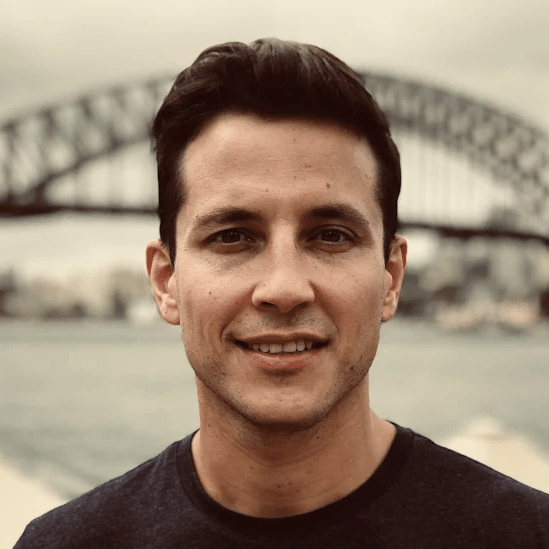

Gabriel Pincus, President and Founder, GA Pincus Funds

The first step if you would like to keep business and personal expenses separate is to ensure that your business expenses are kept separate from your personal expenses would be to register your company as a separate entity. You may register your company as an LLC (Limited Liability Company) or something comparable. Then you ought to get an EIN (Employee Identification Number) for your business. This can be done for free on the IRS site.

For more information on the different small business entities, read our article on LLCs, S-Corps, and C-Corps.

2. Open a Separate Business Bank Account

Greg Corey, Founder and Principal, Porchlight

As a business owner, it’s very important to have two separate bank account — one for your personal expenses and another one is to get your business. However, it’d be better to open a business bank account with a different bank from where you can maintain your private bank account with. This way, you will not be tempted to move funds from your private account to your organization account, or vice versa.

To learn more, check out our articles on the best business checking accounts and best business savings account.

3. Hire A Reliable and Trustworthy Bookkeeper

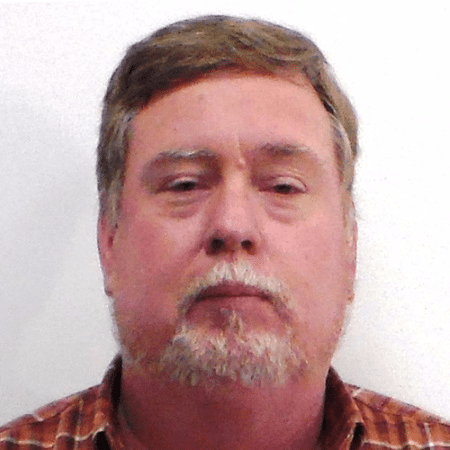

Mark Aselstine, Founder, Uncorked Ventures

Maintaining your business and personal finances can be very challenging especially if you simply do this on your own. This is the reason why it’s a fantastic idea to hire a good and dependable bookkeeper to help ensure that you don’t mix your company and personal expenditures. Ensure your bookkeeper has a keen eye and can be trained how to spot small errors immediately.

4. Use Accounting Software for Your Business

John Kinskey, President & Founder, AccessDirect, Inc..

An accounting software like QuickBooks will help you monitor your company’s income and expenses, track your financial transactions, and create statements. By using a dependable accounting software, it would be easier for you to make certain that your company expenses are not combined with your private expenses.

For more information, take a look at our article on the best small business accounting program .

5. Maintain Independent Online Accounts for Your Business

Dave Robinson, Founder & Managing Partner, Driven Insights

Even during the early phases of your company, it’s a smart idea to keep separate online accounts which are exclusively intended for your business. Accounts such as PayPal and Amazon — if you would like to buy business-related stuff online — must be made separately for your company. This will definitely make a record on which online transactions are performed for company purposes only.

6. Monitor the Expenses of Personal Items for Business Needs

Grant van der Harst, Managing Director, Anglo Liners

If you frequently use your personal items for business needs, like your vehicle or phone, make sure to keep tabs on just how much this will cost you. The ideal method of maintaining a grasp of what you are spending on the company would be to log your expenses. Keep receipts to the price of gas used for business travel and the cost of business calls.

7. Loan Personal Money to Your Business Only When Necessary

Katie Hellmuth Martin, Co-founder, Tin Shingle

Are you financing your business from your own personal funds? You may do this only when necessary — but you have to ensure that you loan the cash to your business and log this to your accounting software as a business loan. Monitor how much your company has borrowed from your personal funds, and ensure to set a strict payment deadline for your business to pay the money it owes for your private account.

8. Utilize a Business Credit Card For Business Expenses

Deborah Sweeney, CEO, MyCorporation.com

If you are a small business owner, it’s absolutely necessary to use a different, small business credit card intended only for company expenses. This makes it a lot easier to track spending and maintain personal and business expenses separate for write-offs associated with company expenses. It also lets you build credit for your company that is independent of your personal credit and assists address potential problems of fraud.

To learn more, take a look at our article on the best business credit cards.

9. Provide Employees With Pre-Paid Business Debit Cards

Lou Friedmann, Chief Revenue Officer, Bento

As a business owner, you want to ensure you and your workers keep personal finances separate from company finances, and you want to prevent people from overspending. However, many businesses let employees use personal credit cards to get business-related expenses, which may be time-consuming and difficult to control. To avoid this, you can supply your employees with prepaid small business debit cards that the company can use to monitor and control overall spending–ensuring business and personal expenses are different and empowering your company to easily control and monitor all employee spending.

10. File Your Receipts & Bills Into Independent Categories

Kevin Huhn, Founder & Inspirational Speaker, Kevin Media

Separate your business-related receipts and bills, and categorize each according to which sort of expense they are, such as telephone bills, utilities, payroll, office supplies, travel expenses or gasoline. It is ideal to file them in separate folders with corresponding labels. This can make it much easier for you to keep track the expenses you spend on your business.

11. Utilize the”Class” Feature on Your Quickbooks to Record Personal Expenses

Daniel Passov, President, Greek U Inc..

If you cannot be eligible for a business credit card yet, you may use your personal credit card to your company assuming that you categorize these expenses properly. You can achieve that by using the”course” attribute in Quickbooks, which can be used to different expenses for a business which has two locations. Instead, you may use it to post private cost to have another observation for both private and business expenses.

12. Pay Yourself as an Employee

Jeff Groesbeck, Founder, Impact Martial Arts

Even when you’re the business owner, you should pay yourself as an employee, especially if you handle your business. You should be a regular part of your business’s payroll. This way, you can have the budget and funds for your personal finances. If you don’t pay yourself, you might end up using your business funds for your personal expenses.

13. Stick with Your Business’s Budget

Steve Pritchard, Business Consultant, GiffGaff

Specify a strict budget for your organization and keep it up. Frequently, small business owners make the mistake of allowing themselves to discuss budget, which then requires them to tap into their own financing to keep the company afloat. But this does is blur the lines between personal and business expenditures. Setting a clear budget that’s dependent on your company’s current earnings can help you to maintain your personal and business finances separate.

14. Utilize Cash for Your Own Personal Expenses

Cristian Rennella, CEO & CoFounder, elMejorTrato

If your organization is relatively fresh and opening a business bank accounts is not yet feasible, you may separate your own personal finances using cash for all your personal and family expenses. In this manner, all your banking transactions, for example check issuance and credit card use, are business-related expenses, which makes it simpler to track.

15. Immediately Reimburse Personal Money Used For Company

Blake Snow, Author, Log Off

It’s important to have a separate bank account and credit card for your enterprise. However, in case you forget to bring your small business charge card and you need to spend to get a business-related cost, such as, for instance, a business lunch with a client, for example, you must immediately refund yourself the quantity of money that you used from your private money, and this settlement has to be supported by receipts.

16. Document How Much You Invested in the Company

Paola Garcia, Small Business Advisor, Excelsior Growth Fund

You ought to avoid commingling your private money and your company funds. But sometimes you have no other choice but use your personal funds for business expenses, particularly when your company is brand new. When this occurs, keep a record of and the receipt for every expense you paid off. It is important to document how much personal money has been invested in the industry as this shall form a portion of your investment.

17. Get Your Tax Filed By a Licensed Accountant

Alexis Chateau, Founder & Managing Director, Alexis Chateau PR, LLC

Employ a certified and experienced accountant to file your business taxes, rather a CPA. This makes sure that your business’s financial records are error-free rather than blended with personal expenses. This supplies you with the assurance that you get every business write-off available to you. The cost of hiring a lawyer is worth your peace of mind when it comes to filing taxes.

18. Invest in Assets Intended Only For Business Utilization

Kevin May, President, LandHub.com

1 thing you might do in order to separate your business from personal finances would be to have different items meant for business use only. For instance, you should buy a separate phone to your business if you constantly need to make business calls. If your company requires you to travel often, then invest in another car for company use. This way, you are able to clearly identify the costs used for business.

19. Hire a Finance Manager or Controller

Kirk Herzog, Office Manager, Expert Plumbing & Rooter, Inc..

To ensure that your organization and personal expenses do not mix, you can employ a finance supervisor or controller to work as a gatekeeper on your business’s finances. This personnel acts as a’maker’ for all expenditures, while you, as the owner, act as the’checker’ or’approver’. This way, there are two sets of eyes to inspect your business expenses are extremely business-related and that they are paid out of business funds.

20. Don’t Use Business Funds to Pay for Personal Assets

Anna Wood, CEO, Brains Over Blonde

Your new company is an investment that you need to protect from yourself and others. It needs to be treated as a separate entity from your own personal life. This usually means your company funds should not be used as a way to cover your own personal expenses, even when you are the sole owner of the business enterprise. Additionally, refrain from’borrowing’ money from your business accounts for your private use.

21. Educate Your Loved Ones & Friends

As a small business owner, sometimes your family, relatives, or friends will ask prefer from you which may influence your small business. This ranges from requesting special discounts, free products or services, or borrowing money from your business funds. According to American Express, it is vital to ensure everyone on your close circle understands that your company is a separate entity from your own personal life.

22. Independent Shared Expenses

If you have to multitask, Chron recommends that you track shared expenses, as much as possible, get separate receipts. As an example, you have to buy school supplies to your children and some supplies for your office. To maintain finances totally separate, it’s ideal to ask the cashier to scatter the items individually, paying for the office supplies with your business credit card along with the school provides with cash or your own personal credit card.

23. Be Cautious About Mixing Business & Leisure

According to IRS Publication 535, travels, meals, and entertainment must be directly related to or related to your business for all these expenses to be tax deductible. Sun National Bank recommends that you keep business lunches and other work tasks different from events with friends and family to avoid confusion.

To learn more, read our post about travel and entertainment expenses.

24. Have Two Sets of Financial Records

It’s important to maintain a financial record for everything you pay — both business and personal expenses. This is essential for tax reporting purposes. Old National suggests that you should record every cost you create — either for business or personal — so you can keep track of your finances and see if you’re spending within your means and budget.

25. Rent Space For Your Home-Based Business

If you are a home-based business and therefore are utilizing part of your house as an office location, you can rent this space to your business. You may produce paperwork that documents the terms and conditions of the rental agreement, and you are able to charge your company a fair amount as rent for utilizing a space in your home.

Bottom Line — Keep Personal and Business Expenses Separate

As a small business operator, you might find it hard to draw a definite line between your business and personal finances. However, it’s required to keep business and personal expenses separate if you want to accurately monitor your business’s performance. Make certain to keep in mind these 25 expert tips every time you are tempted to mix your financing.