A pay stub is a document that serves as a record of a worker’s paid wages displaying pre- or post-tax deductions obtained. We offer over 50 free cover stub options that will help you comply with state laws in the over half of U.S. states that require employers to give pay stubs — even in the event that you pay employees with direct or cash deposit.

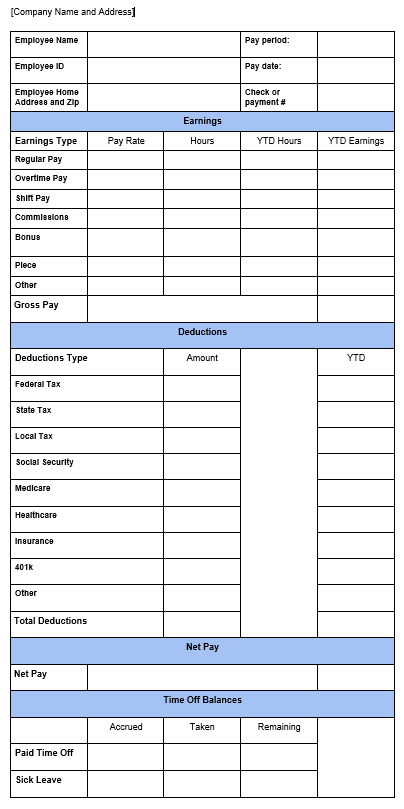

Downloadable Pay Stub Template

Here is a simple downloadable pay stub template that you can open, input your information into, save and/or print. It contains all the fundamental data fields you might choose to use to document deductions and earnings. Any rows or words you don’t use may be left blank, customized or deleted from the template to create this work for your company.

- Pay Stub Template in DOC format

- Pay Stub Template in PDF format

To avoid having to make manual pay stubs, think about using a low-cost payroll service like Gusto that may provide your employees not just with pay stubs, but using look at their private information, including time-off accounts online.

Try out Gusto

What a Pay Stub Template Should Include

What to add on a pay stub is generally ordered by state law. By way of example, some states like Arkansas and South Dakota do not require employers to give pay stubs to workers in any way. But providing a pay stub is similar to supplying a customer with a payment receipt. It demonstrates, in case you’re audited or have an employee dispute, then that payment was made.

Just how much detail you need in your pay stub depends upon two things:

- What condition your workers work in

- What rewards your company Offers

26 states require employers to give pay stubs. Only 11 states need the pay stub to be printed out or provided on paper. Nine states have no requirement for companies to give pay stubs in any way. The rest of the states let companies and their workers decide together whether pay stubs are supplied — employees can opt in or out of receiving them.

For instance in California, details like hours worked, pay period start and finish dates, and any piece work (number of components and rate) must be included on the worker’s paper pay stub. In Nebraska, you’re expected to include available and used paid time off or sick leave information. But in Florida, unless your workers are in a marriage, you’re not required to offer a pay stub in any respect.

Example of a pay stub from Nebraska where leave accounts are provided

Be sure to verify your particular state’s needs for what to include on your workers’ pay stubs.

The most common data fields to include in your pay stub template would be:

- Your Organization’s name and address

- The worker’s name and employee ID

- The cover period represented

- The date that the employee was compensated

- The gross salary, such as overtime and regular pay

- Hints, commissions, or other earnings

- The pre- and – post-tax deductions obtained from the worker’s earnings

- The employee’s net pay

To make certain your pay stubs are both calculated correctly and include the essential information to your location, consider using a payroll provider such as Gusto.

Try Gusto

Many cover stub templates contain useful details such as the number of hours worked during the pay period, year-to-date accounts, and paid time off taken. They might also have certain descriptions on the purpose of pre- and – post-tax payroll deductions, like for medical insurance, life insurance, commuter benefits, or uniform fees.

What Every Field on a Pay Stub Means

Though pay stubs are not mandated by the Fair Labor Standards Act (FLSA), the Department of Labor (DOL) does require companies to keep track of specific payroll data, therefore most payroll templates may include room for basic earnings and deductions data, for example:

- Pay Interval — Based on the condition requirements, this can be the start and end dates, or the pay period end date only, as shown from the ADP template illustration below

- Hours Worked — not all countries need the hours be listed on the pay stub, but it is a best practice because you have to monitor the information to ensure overtime is paid properly — for example, 40 hours regular plus 6 hours overtime equals 46 hours complete in pay period

- Gross Earnings — this includes hourly earnings, commission earnings, tips and any earnings based on piecework — each type of earnings is generally shown as a separate line item on the pay stub

- Required Taxes — include a lineup to reveal all federal taxes, state taxes, unemployment taxes, local taxes (if any), in Addition to social security taxes deducted from worker earnings

- Taxable Deductions — include Another line item for any taxable deductions, such as wage garnishments or uniform fees

- Tax-Free Deductions — include a separate line item for any pre-tax benefits or retirement plan contributions, for example health insurance, life insurance, FSA, HSA, or 401k contributions

- Time Off Balances — this information is helpful to the worker, but also required in states including California and New York who have mandatory paid sick time legislation

Example of an ADP branded cover stub template from PDFFiller showing where information goes

Where to Locate 50+ Other Free Pay Stub Templates

Employing a pay stub template is a simple fill-in-the blanks way to ensure you’re correctly documenting your employees’ gross earnings, deductions, and their net pay. If you’re trying to find a wider variety of alternatives to fit your needs, these websites provide over 50 different free pay stub templates that you could utilize.

- Smartsheet — This online collaboration software provider offers 10 cover stub templates in PDF and XLS formats

- PDFFiller — This online fill-in-the-blanks site enables you to pick from three cover stub templates

- MS Office — If your company already uses the MS Office suite, you’ll be Pleased to know they provide a pay stub template in XLS format that calculates basic payment details

- Free Template Downloads — This site provides 29 Distinct templates in various formats

- Template Lab — This Website provides 10 pay stub templates in DOC, PDF, and XLS formats

Straightforward sterile cover stub template downloadable for free from Template Lab

Online Pay Stub Generators

In addition to cover stub templates, you will find on-line cover stub generators that allow you to enter your pay stub data manually. Some, like FormSwift, provide a free trial and many others, like ThePayStubs, permit you to select your very own professional looking templates which cost a few dollars to use.

Here are 3 online pay stub generators you may find useful:

- Purchase Stub Generator — This free tool on Shopify allows you to enter your payroll data manually, and it creates a pay stub for you. It then requests your email address and sends the finished pay stub to you to download or print.

- ThePayStubs — This website provides 10 pay stub templates and provides a tool to allow you to fill the blanks in online. You’ve got to pay about $9 for each pay stub you create. Besides pay stubs, you can construct and print W-2s and 1099-MISC documents too.

- FormSwift — This free tool lets you input payroll information and creates a pay stub for you in DOC or PDF format. You can sign up for a subscription which begins at $7.95 a month plus they offer you a free seven-day trial.

Fill-in-the-blank pay stub template from FormSwift

Purchase Stub Retention

The DOL does not have any mandatory retention requirements for any particular file such as a pay stub, but it does require that payroll information be kept for three decades. The IRS needs tax documentation to be retained for four decades. And, some states, like California require payroll documentation to be retained for six decades.

Read our article that covers federal and state citizenship document retention requirements to find out more about the length of time you need to keep tax and payroll documents in your state.

The Most Important Thing

When your company first starts out, you may be paying employees out of your checkbook or donating them money. If you are not using a payroll service, it is important to maintain some kind of record of that payment and any taxes and deductions, like a pay stub. Additionally, pay stubs help you satisfy the DOL necessity to retain payroll documentation, even should pay stubs themselves are not required to be awarded to employees in all U.S. states.

If you work in a state which needs pay stubs be supplied, and/or you get past a couple of employees, it might be time to think about updating to payroll software such as Gusto that could calculate your payroll and provide employee payments, saving you time, and supplying a pay stub as well.

Try out Gusto