A paycard, occasionally known as a payroll cardis a prepaid card card employers use to pay employees who do not possess a bank account. A paycard, as an electronic payment type, is regulated in certain states. Paycards cost little to install and you can get them from dedicated providers, some banks, or even payroll businesses.

We’ll supply you with details about how best to cover your employees using a payroll card rather than or along with a paper check or direct deposit. Paycards provide some benefits over paper checks, notably that employees don’t need to go to banks to them. We will also share tips on paycard providers and dangers to avoid when offering paycards to your workers — such as concealed bank fees.

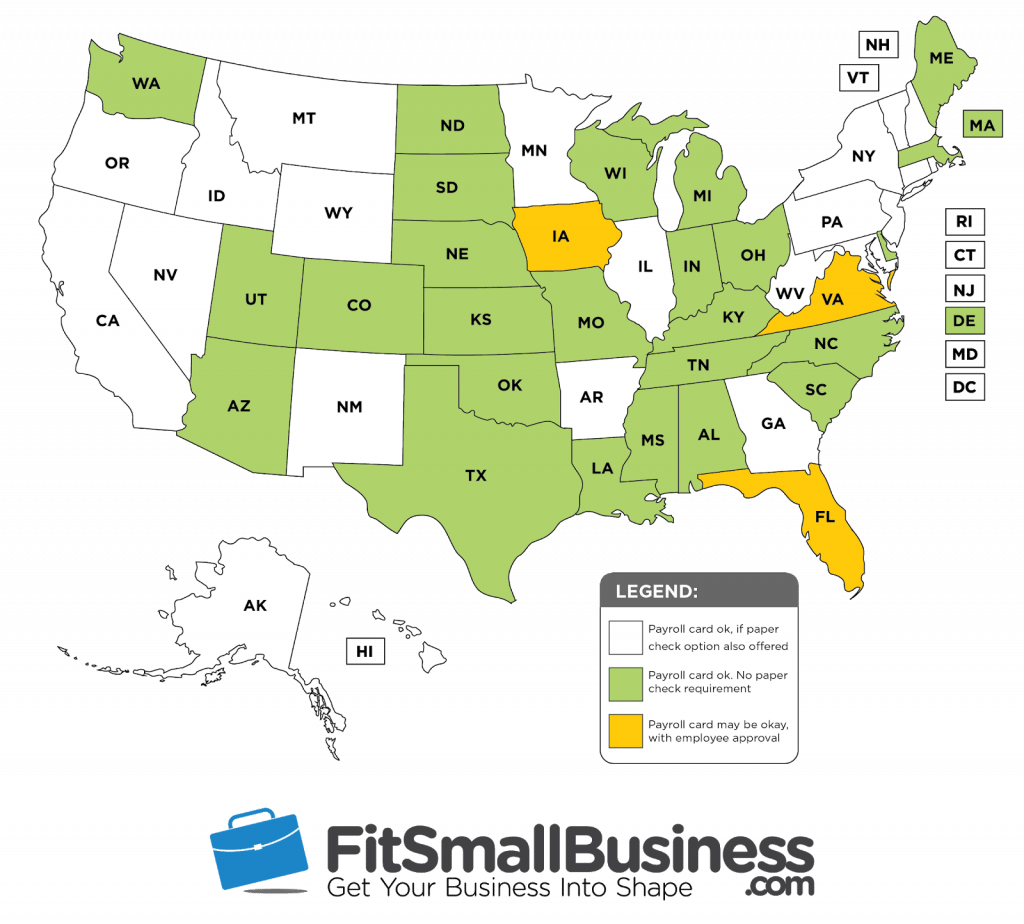

States with Particular Rules on Payroll Cards

The graph below illustrates state requirements for businesses that matter payments electronically, like paycards and direct deposit. As an example, New York and California, shown in white permit companies to offer a paycard alternative, but only along with a paper test. A paperless system isn’t allowed since the sole option in these states.

Regulations by state for using a paycard as an electronic payment method

Data resource: http://rapidpaycard.com/

However, states shown previously in green, such as Texas, allow a paperless pay system like direct deposit or paycard only. They don’t demand a paper test to be supplied. Additionally, most states have paycard regulations, like requiring free ATM withdrawals or ensuring some way for the worker to receive their full pay without paying service fees.

Some countries prohibit employers from getting any kind of commission or getting any benefit from workers’ utilization of paycards. Thus, we highly suggest using a paycard provider — if PEO, payroll software, bank, or credit card company — familiar with worker payment legislation in all states your employees work in.

4 Reasons to Give Payroll Cards to Employees

Most companies use money, paper checks or direct deposit as employee payment procedures. But cash and checks can get stolen or lost — a hassle for you and your employees. And not every employee has a checking account. So here are four good reasons a paycard may make sense for your company.

1. Paycards Are Easier For Employees With No Bank Accounts

The most frequent reason that a company would want to provide a paycard option is that it’s more suitable for employees who don’t possess a bank account. According to the Federal Deposit Insurance Corporation (FDIC), 7% of households don’t have a bank account and almost 20% of individuals don’t use one. The FDIC describes these folks as unbanked or underbanked.

Here’s what one informed business owner says:

“We highly encourage all employees which don’t have a bank account to benefit from this paycard support. The primary advantage for them is their payroll funds are available immediately. The paycards save them with the time (and in some instances cost) of having to cash their checks, as most of them are going to their regional bank or a check cashing company to do so.” — Jonathan Marsh, CAEd, Owner of Home Helpers of Bradenton

2. A Paycard Saves Time

A paycard resembles direct deposit, where the employer transfers payroll funds to the employee’s accounts on payday. The distinction is that instead of the money going into a worker’s bank or credit union checking account, paid wages are added to the worker’s payroll debit card. Jonathan Marsh adds:

“We’re saving time by not needing to process manual checks. The process of setting up an employee using a paycard is fast and just has to be done once for an individual employee.

Marsh notes another time-saving benefit:

“The biggest advantage is that paycards permit for the company to acquire out tax dollars from the business bank accounts instantly upon processing ”

So along with saving administrative time, you’ll save yourself time reconciling your account or stressing about escheatment.

3. A Paycard Saves Money

Even a paycard saves you money over standard paper checks, whether in time spent printing them and passing them out, or in the cost of postage and paper. Like direct deposit, it typically costs you nothing to supply a paycard option for employees, although some taxpayers sellers may get an upcharge for managing electronic payment choices.

Let us say you run payroll every other week for 25 employees. That is 26 payrolls a year for 25 employees at 50 cents for every standard first class stamp at the post office. That would cost $325 a year only in stamp; your administrative time, paper, and envelopes cost additional.

And if tests are dropped, voided, or reissued, that costs more. With paycards, once citizenship is processed that the cash is there.

4. A Paycard Helps Prevent Check Fraud

Check fraud happens when someone steals your business data, such as the routing number on your checking accounts, to obtain unauthorized access to capital. It may also occur when someone modifies the test in some way, like changing the quantity or the recipient’s name.

But even if a paycard has been stolen or lost, it is less risky than a check. The paycard, for example any prepaid debit card, requires the use of a PIN to acquire funds; which reduces the danger of unauthorized use. The paycard itself may be replaced.

Payroll Card Providers

Newer vendors focused solely on paycards can provide employers with exceptional paycard options for employees. Some examples are Global Cash Card, fast! PayCard, FlexWage Payroll Card and Sole. Often your payroll software may be set up to direct electronic payments to those third-party paycard suppliers in much the exact same way you set up direct deposit.

Some of those paycard providers pay attention or provide rewards points. Other folks send text messages card holders once funds are obtained. Most cost little or nothing to get the employer to prepare. However, we urge FlexWage if you want a card which issues the same day it is requested and protects workers’ funds with a Visa liability insurance policy.

Try FlexWage

In addition to operating with a paycard provider, you could have the ability to set up paycards with your current payroll service provider, bank, credit card company, or maybe a professional employer organization (PEO). A few of those providers may provide extra services to your company beyond simply supplying paycards.

Payroll Service & Software

Most online payroll service or software companies have an option to present electronic payments like direct deposit or paycards. Many have the ability to issue employees a paycard directly or by working with a third party paycard provider.

Payroll software streamlines your entire payroll process by allowing you to input hours, wages and employee information. It processes net cover, often by letting you print checks or provide electronic payments using a one-time setup.

If payroll software sounds like a fantastic alternative, we recommend Gusto as a small business payroll software provider that provides your employees the choice of being paid with a paycard. Gusto begins at just $39 a month and $6 per worker. You get HR, benefits, payroll processing and a free timekeeping option at the cost.

Try out Gusto

Banks & Credit Unions

Since paycards are much like credit and debit cards, banks such as Chase and US Bank, and credit unions offer paycards as part of their suite of business banking solutions. In fact, Chase ports with ADP to provide paycards in 23 states. However, be aware as there are penalties your workers may incur following the first couple of paycard withdrawals. Should you go this route, be sure you look for a paycard option that is free for your employees to utilize.

Attempt Chase

Credit Card Providers

Similar for banks, credit card providers such as Visa, Mastercard, and American Express also offer prepaid debit card choices that workers can use as a paycard in place of direct deposit.

Try Visa

Professional Employer Organization

The very hands-off way to provide a paycard payment option to your employees is to operate with a professional employer organization (PEO) that manages most of the employee HR and payroll administration for you. Of course, you wouldn’t partner with a PEO only for a paycard.

A PEO can provide your business with human resource (HR) services, employee benefits, payroll processing, and year-end taxes, and payment options such as a paycard. Therefore, if you’re already using a PEO, or are considering working with you, then asking about their paycard options is a smart next step.

We have reviewed several PEO companies that range in cost from $39 to $155 per worker per month and advocate Justworks if you’re considering using a PEO that offers a paycard option.

Try out Justworks

Beware of Payroll Card Fees

There are not many downsides to supplying a paycard so long as you follow the rules in your state. But be conscious of fees that your employees may be billed. Some ATMs charge expensive service charges, up to $5 or more per withdrawal. Banks may also bill workers to check balances or withdraw money. Marsh adds:

“The single downside I have observed from making use of a paycard is for your worker. We signed up the company to your paycard service following being marketed to by a paycard provider, who offered us all of the free details of the service. But, our employees have found that some services linked to the utilization of these paycard do incur penalties for example as some ATM withdrawals in addition to balance inquiries via phone call.”

Teach Your Employees concerning Paycards

In the event you decide to provide your workers with an option to use a paycard instead of deposit or a paper check, ensure you spend a couple of minutes teaching them on how to avoid paying service fees. Include topics such as:

- The best way to utilize in-network ATMs, bank tellers, or POS methods to obtain money and balance information to avoid paying penalties

- How to store their PIN by memorizing it, and not having it written down or kept anywhere near their paycard

- Who to contact if they want a replacement card if theirs is stolen or lost

The Bottom Line on Paycards

While offering paycards is an excellent alternative, it shouldn’t take the place of other payment methods including direct deposit — after all, employees like having a selection. But in nations where it’s legal to provide a paycard instead of a paper test, it can help save you both time and money. Consider offering a paycard to your staff, particularly in the event that you employ workers with no bank account.

Do not forget that Gusto can offer employee payroll cards as a payroll option, as well as full-service HR, payroll and benefits.

Try out Gusto