For many small business owners, offering employee benefits beyond those legally required is a”maybe someday” sort of thing. They take energy and time to prepare and sap money from the revenue flow.

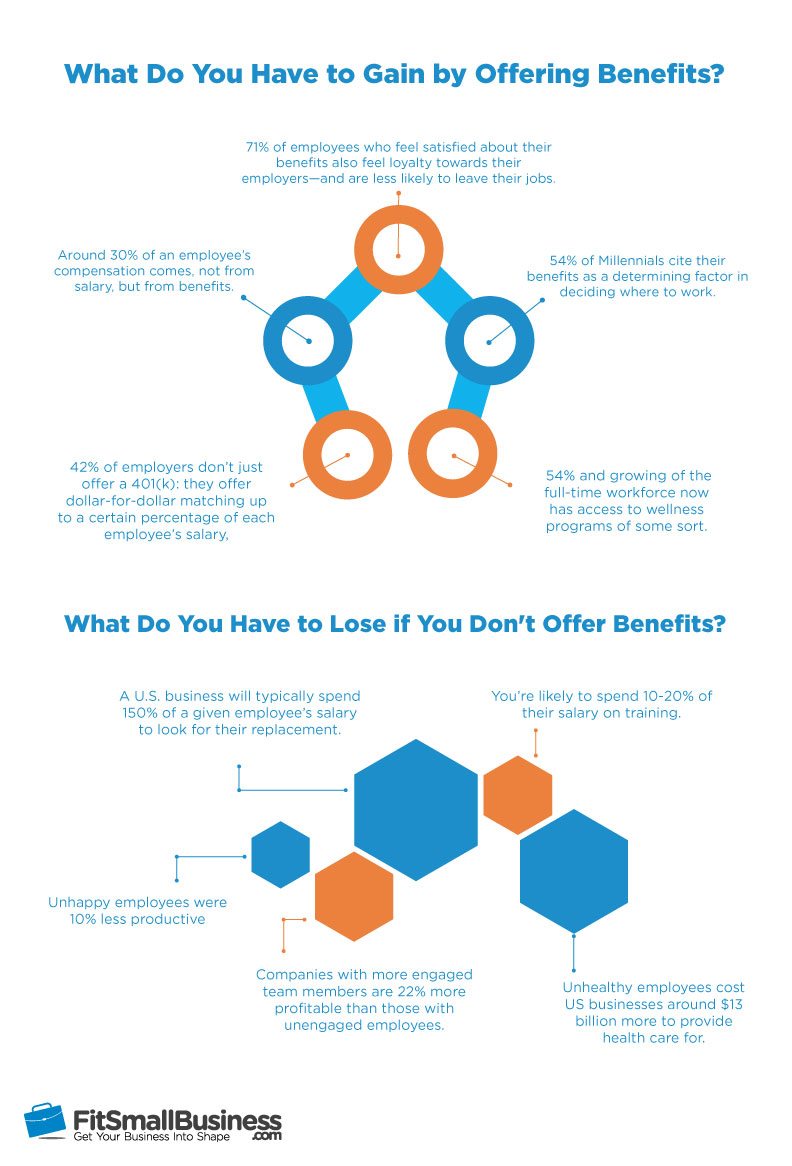

But offering great benefits package now can pay off in a significant way for your company later on. 71 percent of employees who feel satisfied about their benefits additionally feel loyalty towards their employers–and are less likely to leave their occupations.

Let’s take a better look at some company benefits stats to see how providing worker benefits can help your bottom line.

Statistically Speaking: Just How Good Benefits Can Benefit Your Business

Offering advantages beyond those that companies are legally required to provide can be a costly proposition, but, information shows, profitable for your company in the long term. In fact offering more human centered-perks is one of this years top 5 office trends. Let’s see three ways your company may gain from gains!

Reward #1: Recruiting

Employee benefits are a great way to attract fresh talent to work for the small business.

Think about it this way: approximately 30% of a worker’s compensation comes, not from salary, but from benefits. And although different kinds of workers will have different sorts of needs, they will all need benefits that wages alone can’t provide.

Whether this means investing in superior health plans or vision and dental, or retirement plans and life insurance, or offering commuter benefits, or perhaps focusing on less monetary benefits that younger would-be employees may care more about (like open office hours, adaptive holiday days, or even annual getaways), you need to know who you want to hire and what they need out of their jobs.

By way of instance, according to a study, 54 percent of Millennials cite their benefits since a determining variable in deciding where to operate. This means that you could be losing out on young, passionate employees simply as your benefits package isn’t aggressive.

And even if you aren’t planning to recruit Millennials specifically, it is important to keep in mind that most other job-seekers continue to be heavily weighing your benefits package against competing supplies. For another example, a whopping 42 percent of employers don’t only offer a 401(k): they offer dollar-for-dollar matching up to a certain proportion of every worker’s salary, based on a 2015 study. If you are in another 58%, you’re at a significant disadvantage when it comes to non-salary factors.

If it comes to your bottom line, recruitment may have a critical impact. Consider it this way: you’re on the lookout for an employee since you have identified an area for potential expansion a complete – or part-time employee might help you make the most of. Past the time and energy you spend poring over resumes, conducting interviews, posting on job boards, and networking, you also have to manage the possibility cost of not pursuing those upcoming steps for your company as you recruit.

Bonus #2: Retention

Benefits don’t only help you get employees–they help you maintain them.

You can look at employee benefits and retention in 2 ways:

1. Losing to the Competition

To begin with, in terms of losing workers to other businesses. If another business comes along and offers your worker a greater salary, then you might stand a chance if you provide strong advantages that relate to their needs.

In reality, a single 2015 survey found that 40 percent of employees would give a wage increase in order to keep up their present degree of health insurance coverage. That’s correct: if the health your business offers is great enough, you might actually protect your workers from being poached by other businesses with higher salary offers.

You also do not have to think only in terms of 401(k) and health insurance plans. If you tailor your company benefits to what your employees, specifically, need, then you will be miles ahead of the competition. Can they journey from far away or feel strongly about working for a green company? Think about setting up a commuter benefits program. Is your company focused on health and wellness? 54 percent and growing of the fulltime workforce now has access to health programs of some sort, whether they’re smoking cessation programs, weight loss training, or health subsidies.

2. Catering to Your Workers’ Needs

Secondly, you can look at your benefits package and retention concerning losing employees that are unhappy with your gains. Although a competitive salary might be sufficient for many workers to stick around, studies show that 71% of workers who state that they’re pleased with their gains also state they’re loyal to their employers. People want to feel as though they are treated well–and also advantages can go a long way to assist.

On the flipside, losing an employee for any reason can strike your bottom line hard. Beyond the opportunity costs brought up in the preceding section, there are real financial costs to losing a member of your team. A U.S. company will typically spend 150% of a certain employee’s salary to look for their replacement, though it is based upon the kind of worker. Plus, for the first one to 3 years of an employee’s tenure (again based on the standing and business), you are most likely to spend 10-20% of the wages on training.

If not offering adequate advantages is causing your workers to appear elsewherethen it may be time to bite the bullet. And if you think that it’s too early to stress, then look at this: the smaller your company, the bigger the loss of a worker would impact you.

Bonus #3: Productivity

Ultimately, besides helping you to get and maintain the ideal workers, offering benefits can actually make those workers work harder, faster, and better.

Sounds almost too good to be true, right?

But we’re not kidding. Studies demonstrate that with the right mixture of benefits, it is possible to boost your company’s productivity–and bump up your bottom line.

There are two ways to look at the association between better rewards and increased productivity.

1. Happy Workers, Happy Company

First is the simple fact that, generally speaking, happier workers work harder. While this can be an age-old maxim, the information demonstrating it right has started to pour –especially after the 2008 fiscal crisis. One 2010 study, for example, discovered that the higher disengagement and reduced job satisfaction many Americans reported really contributed to $300 billion dropped in productivity every year, and yet another report had this amount pegged even higher, at as much as $550 billion.

On the positive side, happy employees are more likely to work better and come up with new thoughts. Another study finds that, specifically, more happy employees were 12 percent more productive than ordinary (and sometimes as much as 20% more productive over brief spans of time), while unhappy employees were 10 percent less successful. Productive, in these scenarios, mean using time efficiently: acquiring similar quality results on jobs while spending less time.

And there is lots of room for improvement: 87% of employees nationally aren’t fully engaged with their work, so your company could edge out the competition simply by treating your employees better. In reality, businesses with more participated staff members are 22% more profitable than those with unengaged employees.

While offering a rewards package isn’t the only means you can make your employees happier, it is a significant one–especially when compared to variables like wages raises, which have never been shown to affect productivity during job satisfaction the exact same way. Whether this implies occasional catered foods or company parties, yoga or meditation advisers, health and wellness programs, summer Fridays, management coaching with a concentration on positive feedback, or several other added benefits, the information is clear: improving your employee participation can help your business thrive.

2. Healthy Workers, Healthful Business

Benefits can aid your business at a seemingly imperceptible manner, increasing productivity (and profits) by keeping workers contented and engaged. But there’s a much more tangible connection between rewards and your bottom line:

The wellbeing of your employees.

Of course, nobody likes it if their workers need to take sick days–it’s inconvenient, unpredictable, and no fun for anyone. However, the health of your employees may have a serious impact on your business beyond these minor issues. In fact, American companies lose between $150 billion and $225 billion each year due to worker illness. Unhealthy employees cost US businesses around $13 billion more to provide health care for. Additionally, several states now require that employers offer a specific number of paid sick days to their employees.

To add another layer of sophistication, these earnings losses are not solely as a result of sickness-related absenteeism. You can depend on reduced productivity when employees come in to work while sick, too –and possibly spread their illness to others. Chronic conditions, like stress, obesity, or substance abuse, can bring about the estimated reduction of 115 effective hours each calendar year too.

And tiny companies with fewer workers, thinner margins, and smaller money cushions will feel these effects particularly strongly.

Here’s where rewards come in.

First and foremost, investing in high excellent health insurance programs that appeal to the demands of your workers (and their families) can make it easier for them to stay healthy, keeping premiums down and productivity up. (Plus, studies reveal that workers with health insurance choices feel greater loyalty to their companies –that makes sense, given that over 50% of Americans rely upon their employers for healthcare )

So while it might be tempting to go with the cheapest, most barebones strategy you’re legally required to offer, settling on a better plan is an investment in your employees–and your business. Finding the right health insurance plan may be a time-consuming and complex process, but it’s often worth the effort in the long term.

Secondly, there are other kinds of advantages you could offer that target health and wellness in less straight financial ways. By way of instance, you could subsidize gym passes–or perhaps construct an employee gym space, if your business is big enough, since they actually pay for themselves within a couple of years. You might also offer incentives for workers to combine weight-loss lunch programs, stick to certain diets, quit their smoking habits, provide coverage discounts or gift cards for healthy behaviors, and so on.

Which Benefits Are Right For Your Enterprise?

The sign of a savvy small business owner is focusing on the now–while always looking forward.

Offering employee benefits, while seemingly an unnecessary cost today, is a sizable investment in the future of your business. But what works for one business may not work for another. Here is the way to decide on a rewards package that make sense for your company.

Legally Required Employee Benefits

You want to make sure that you offer the employee benefits required by law. Please note that this is general information only. If you are in doubt about which laws are applicable to your business, we recommend that you consult a lawyer.

Under the legislation, most employers must Offer the following employee benefits:

- Social Security taxes. Both the employer and the worker must pay these. The present rate is just over 6 percent, plus nearly 1.5percent for Medicare taxes. Find out more about Social Security taxes, filing instructions, and hiring workers not covered.

- Unemployment insurance. Depending on your condition of operation, you might have to insure your workers against job loss.

- Workers’ Compensation. Again, the particulars of what you will need to pay for depends upon your condition, so ensure you’re aware of the regulations. Learn more here.

- Family and Medical Leave. You are required to give workers 12 weeks of job-protected unpaid leave due to reasons related to childcare, care of an immediate family member with a serious health issue, or care of the worker themselves because of some health issue. While you don’t have to cover this leave, you must keep these workers on their health insurance plans. Learn more here.

- COBRA. If your business employs 20 or more workers, then your workers can maintain their health insurance programs for up to 18 months later leaving your business (in addition, some states require employers to provide paid sick leave).

In addition, if your small business has 50 or more employees, you’re also required to offer you some form of health insurance–or face a tax penalty. This is currently the legislation under the Affordable Care Act, though it might be subject to change in the coming months or even years.

Going Above & Beyond

Business benefits stats show out that, broadly speaking, spending on your employees will pay it forward for your business later on. Whether that means going the extra mile to procure a health insurance program which can really help your employees the most, offering wellness benefits to boost engagement, or for example packages for commuting, skill development, and more, it is all up to what you can afford, what your employees want, and what your manufacturer matches up .

This doesn’t mean that you should spend every cent you make on worker benefits, naturally, but you ought to get away from the”small company owner grind mindset” from time to time and realize that focusing on employee happiness, health, and civilization will pay dividends as you grow.

About the Author:

This post was written by Ben Rashkovich. Ben has written and edited articles on entrepreneurship, small business, finance, choice financing, and more for books like Fit Small Business, the Fundera Ledger, Forbes, Business Insider, Huffington Post, and more. Previously, he served as the Content Strategy Manager for Fundera, worked on eBay’s curatorial staff, and noted to the Columbia Spectator.