Free business checking accounts don’t charge a monthly service fee. But, even these”free” checking account generally charge fees for additional services. We looked in the fee arrangements of this available free business checking account and picked Capital One, US Bank, and BBVA Compass.

Fit Small Business Uses: Bank of America

The company behind Fit Small Business has been banking with Bank of America for five years and plans to continue to use Bank of America because of its company checking. They’ve over 16,000 ATMs across the nation for your advantage, and their Company Fundamentals accounts is free with a $3,000 minimum equilibrium (or upon fulfilling other criteria). New customers may qualify for a bonus of up to $350. Click here to find out more.

Visit Bank Of America

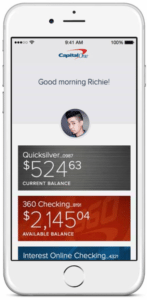

Greatest Free Small Business Checking Account: Capital One Spark Business Checking

Capital One Spark Business Checking is our choice as the greatest free business checking accounts. There’s no monthly fee to use this free account and it’s lower fees for extra services when compared to US Bank and BBVA Compass, like a lower monthly payment and a lower money deposit fee.

Visit Capital One

Best Free Business Checking Account

| Monthly Fee | Number of ATM’s | Number of Branches | ||

|---|---|---|---|---|

|

|

None | 40,000+ (2,000 accept deposits) |

700+ |

Visit Capital One

|

|

|

None | 5,000+ | 3,000+ |

Visit US Bank

|

|

|

None | 40,000+ (1,000 accept deposits) |

650+ |

See BBVA Compass

|

*Last Updated: March, 2018

Free Small Business Checking Account Comparison Table: Capital One vs. US Bank vs. BBVA Compass

|

Monthly Fee

Learn More |

No Monthly Fees | No Monthly Charges | No Monthly Fees |

|

Transaction Fees

Know More |

Unlimited Transactions | 150/Month Free, $0.50 for Every Extra Transaction |

Unlimited Transactions, $1 In-Branch Withdrawal Fee |

|

Money Deposit Fees

Know More |

$5,000/Month Free, 0.2% for Every Additional Dollar Deposited |

2,500/Month Free, 0.3percent for Every Additional Dollar Deposited |

$5,000/Month Free, 0.3percent for Each Additional Dollar Deposited |

|

Wire Transfer Fees

Know More |

$15 Incoming Wire, $25 Outgoing Wire |

$20 Incoming Wire, $30 Outgoing Wire |

$15 Incoming Wire, $25 Outgoing Wire |

|

ATM Fees

Learn More |

No Out of Network Fee | $2.50 Out of Network Fee | No Out of Network Fee |

|

Size of Network

Learn More |

40,000+ ATMs (2,000 Accept Deposits), 700+ Branches |

5,000+ ATMs 3,000+ Branches |

40,000+ ATMs, (1,000 Accept Deposits), 650+ Branches |

|

Entry

Learn More |

Online Nationally, Branches in CT, DC, DE, LA, MD, NJ, NY, TX, VA |

Online Nationally, Branches in 25 States Across the U.S. |

Online Nationally, Branches in AL, AZ, CA, CO, FL, NM, TX |

| www.CapitalOne.com | www.USBank.com | www.BBVACompass.com |

Greatest Free Business Checking Account: Capital One Spark Business Checking

Capital One Spark Business Checking is our pick as the best overall free small business checking account as it doesn’t have a monthly fee. It also has the best fee arrangement for additional providers compared to US Bank and BBVA Compass.

By way of instance, Capital One does not charge a monthly payment and has the cheapest cash deposit fee on the list. The two US Bank and BBVA Compass, on the other hand, charge transaction fees for transactions above a particular monthly limitation. Further, US Bank and BBVA Compass charge cash deposit fees for deposits above a monthly threshold.

Capital One also gets the biggest overall network compared to US Bank and BBVA Compass. However, it boasts over 40,000 ATMs, only 2,000 of these accept deposits in addition to issue withdrawals. This is over BBVA Compass but much below US Bank’s community of fully-functional ATMs.

What is more, Capital One just has 700 nationwide branches across 9 states. This is over BBVA Compass but less than US Bank’s federal branches.

If you’re searching for a free small business checking account using a large and flexible network, you may want to check out US Bank. The US Bank Silver Business Package gives the largest network on our list regarding fully functional physical places.

Further, some checking account for example with Chase Bank, while they charge a monthly fee, make it straightforward to waive that charge. If interested, check out our post on the greatest small business checking account with a fee.

Visit Capital One

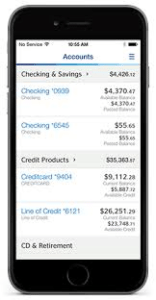

Best Free Business Checking Account using a Large Network: US Bank Business Silver Package

US Bank Silver Business Package is our choice for the best free small business checking account using a massive network. While it’s typical for free small business checking account to be predominantly online, US Bank offers a free business checking account with over 8,000 fully functional locations across 25 countries.

This is in contrast to Capital One and BBVA Compass, both of which have a limited network in terms of functionality. By way of example, US Bank has more than 5,000 ATMs that accept checking deposits that is more than twice the number of both Capital One and BBVA Compass.

What’s more, US Bank has over 3,000 nationwide branches, giving it the largest network of physical places on our list. Capital One and BBVA Compass only have 700 branches and 650 branches, respectively.

However, the US Bank Silver Business Package gets the highest fee arrangement on the list. If you’re trying to lower your fees, it may be wise to go with either Capital One or BBVA Compass, both of which have a comparable fee arrangement.

Visit US Bank

Free Business Checking Account Option for Sole Proprietors: BBVA Compass ClearConnect for Business

BBVA Compass ClearConnect for Business is just another good free small business checking account option. It’s a network size that’s similar to Capital One and a fee structure that is nearly as great. This usually means that it’s a lower price option when compared to US Bank and is a fantastic alternative to Capital One in case you’re closer to some BBVA Compass branch. It has a network size that’s similar to Capital One and a fee arrangement that’s almost as great. This usually means that it is a lower price option when compared to US Bank and can be a fantastic choice to Capital One in case you’re nearer to some BBVA Compass branch.

However, BBVA Compass ClearConnect for Business is a free business checking account specifically for sole proprietors. This is only because BBVA Compass only offers its free accounts to one-person companies that are at the beginning stages of growth.

Considering that the fees and networks are nearly comparable, BBVA Compass ClearConnect for Business is a suitable alternative if you’re a sole proprietor who is situated closer to some BBVA place than to a Capital One place. Further, as it’s lower fees than US Bank, it is also a good alternative if you’re situated closer to some BBVA location than to a US Bank location.

If you’re not a sole proprietor you’re going to want to explore Capital One or US Bank instead.

Visit BBVA Compass

In-Depth Review: Capital One vs. US Bank vs. BBVA Compass

Size of Network

A bank’s network represents the entire number of its available ATMs and branches. It is important to note that a few banks have limitations on the capabilities of the networks. For example, some banks have ATMs that allow for withdrawals although not deposits.

Further, some banks have a lot of ATMs however only a few branches. It’s important that if you evaluate the size of a bank’s network that you assess its capabilities and flexibility along with the number of overall places. When it’s making cash deposits or applying for funding — make sure that your lender’s system will function for your industry.

Monthly Fee

It is more common for business checking accounts to charge a monthly fee rather than not. These yearly charges are generally between $10 — $30 and are waived if certain monthly standards are satisfied. However, there are still situations where banks provide free small business checking account without any monthly charges. The 3 accounts on our record do not have a monthly fee and are considered”free.”

But, remember that essentially all small business checking account charge fees for extra services. These services include such matters as transactions, cash deposits, wire transfers, ATM fees, and much more.

Transaction Fees

Even for free small business checking account, it’s typical for banks to charge a payment for surplus checking account transactions. The industry average is 200 free transactions per month, after which a per-transaction fee around $0.45 — $0.50 is billed for each additional trade.

However, these averages are most commonly found on small business checking accounts that have a monthly service fee. Free business checking account will typically offer between 75 — 150 free transactions a month and a $0.50 transaction fee for every additional trade.

Transactions include, but are not Limited to:

- Checks paid

- Checks deposited

- Cash deposited

- ACH move

- Online bill pay transactions

- charge card transactions

If a business owner exceeds the number of free transactions in a month, he or she should expect to pay a small fee for each additional trade. There are some free small business checking account, however, such as with Capital One, which do not charge transaction fees.

Money Deposit Prices

Besides transaction fees, it’s typical for a free small business checking account to bill a cash deposit fee. A cash deposit fee is usually a charge assessed on the total monthly cash deposited by a small business owner. Similar to transaction fees, banks provide a certain amount of free cash deposits before charging a per-dollar fee.

The industry standard for money deposit charges on a free business checking accounts is cash deposit charges is typically:

- $5,000 / month free money deposits

- 0.3% per-dollar fee for every added dollar retreated

Though some free small business checking accounts don’t have trade fees, virtually all of them possess a cash deposit fee.

Wire Shipping Charges

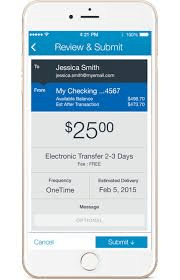

A wire transfer is an electronic funds transfer from one company’s checking account to another company’s checking accounts. Banks typically charge a wire transfer fee between $15 — $30 per domestic transaction and between $15 — $40 per international transaction. These fees are charged for both incoming wires in addition to incoming wires.

ATM Fees

The magnitude of a bank’s network of ATMs is often a determining factor when selecting a free business checking account. This is because banks typically charge an ATM fee if you utilize an out-of-network ATM. The more in-network ATMs a lender gets the lower the chances of being charged an ATM fee.

It is normal to see ATM prices between $2.00 — $3.00 for Indices trades and also fairly common to find banks that don’t charge an ATM fee in any way. But, regardless of whether a lender charges a out-of-network ATM fee, independent ATM providers may also charge a commission of their own, typically approximately $2.00 — $3.00.

Entrance

Free business checking account typically operate on line and also have just a few physical locations. This reduction in overhead allows the banks to decrease their costs and give free business checking account to their clients.

It is therefore important to look at the availability of a free business checking account. All free accounts are available online nationwide, but many only have physical locations in a couple of states.

Other Essential Features

In addition to penalties and network size, there are always additional features that sets you free small business checking account from another. These key features include:

- Accounting integrations

- Mobile programs

- Customer service

Bottom Line

Free small business checking accounts are a fantastic alternative for small and growing businesses. However, while there are no monthly charges, free small business checking accounts typically charge fees for additional services, including transfer fees and cash deposit fees. That is why it’s important to check at the fee structure of every free small business checking account before choosing an alternative. If you are ready to begin, browse our guide about how to start a business bank accounts.

Running a business can be hard — picking a completely free business checking account should not be. That’s why we did the research and discovered Capital One are the best free small business checking account. The Capital One Spark Business Checking doesn’t have a monthly fee, and unlike the other two options on our list, it does not charge a monthly transaction fee. Furthermore, it has the cheapest money deposit fee on our list. If you’re trying to find a free alternative you’ll want to check out Capital One first.

Visit Capital One