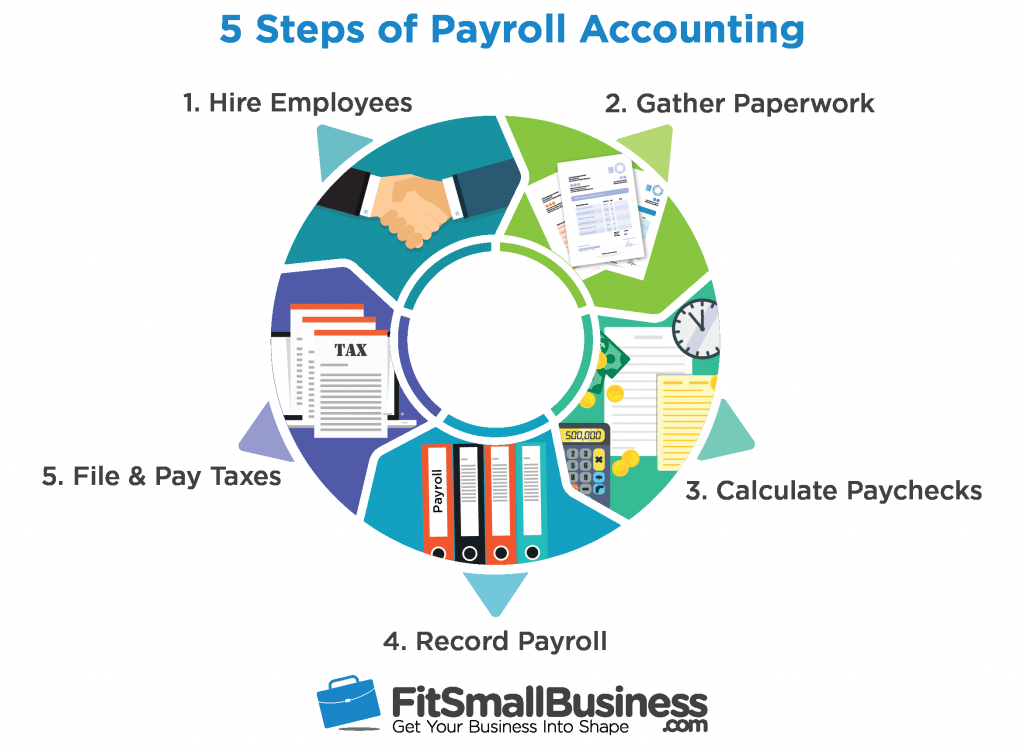

Payroll accounting is the action of recording worker compensation, keeping an eye on money withheld from employees’ paychecks and calculating the employee and employer share of taxation and benefits. You can accomplish this in 5 easy steps: prepare to hire workers, gather key employee documents, calculate & document paychecks and file & pay taxes on time.

1 third of all company calculate payroll taxes incorrect, costing themselves money, time and potentially legal issues. Employing a small business payroll software such as Gusto can make deductions fast and easy and save your company a great deal of trouble. Click here to get a free 30-day trial.

Stop by Gusto

Here Are Five steps on how to perform payroll accounting:

1. Set Up Your Business to Hire Employees

Before you hire employees, there are a couple of choices you will have to create in addition to information you will have to acquire. These things include your salary and income types, desirable benefits, and much more.

Below You’ll Find the Main items You Will Need to setup to start hiring workers:

Get a Federal Employer Identification Number (EIN)

The Federal government monitors all tax payments made by a company using their EIN (Employer Identification Number). It’s free to Obtain an EIN from the IRS.

Pick Wage & Salary Types

You’ll need to decide salary amounts for all your workers and whether you are going to be paying employees hourly or with an annual salary. Have a look at our how to cover workers guide to find out more.

Select Pay Periods

It’s important to establish how many times you will pay employees before you hire them. The most common pay periods used are weekly, biweekly, semimonthly and monthly.

Pick What Benefits You’ll Offer to Employees

Benefits are an integral part of payroll. For instance, if you provide a 401K plan or a health insurance program, then you must determine how much you’ll contribute as an employer and what the worker must contribute in order to participate in the strategy.

Purchase Workers’ Comp Insurance

Workers compensation offers protection for workers that are injured at work or become sick because of the job. Employees’ compensation is mandated by every state except Texas. You may learn more about the price and state requirements in our the way to purchase workers’ comp manual.

2. Gather Paperwork You Need to Pay Employees

Once hiring your employees, you’ll need to place them up in your judicial procedure. For each worker, you may typically need an I-9 form, W-4 form, and direct deposit authorization type, if appropriate. Below you’ll find a downloadable template & a brief description of each one of these kinds.

I-9 Form

All companies in the U.S. must verify that any person they intend to employ is a U.S. citizen or has the right to operate in the USA. This has to be done by completing the I-9 type and making copies of documentation supplied by the employee such as Social Security card, VISA, birth certificate or driver’s license. Click the link for additional info, including a sample I-9 form.

W-4 Form

On the W-4 type, workers will offer information like their marital status and the amount of allowances they want to take for their dependent children. Based on this information, you can calculate just how much income taxes to take out of your employees’ paychecks. Click here to download a sample W-4 form.

Direct Deposit Authorization Form

If you provide direct deposit for your employees, you must get their consent to deposit money into their bank accounts. To do so, you have to have every worker complete a direct deposit authorization form. Click here to download a sample direct deposit authorization form.

In addition, have the employee submit a voided check along with the completed form. This will let you verify that they have given you the correct bank routing and account number. We recommend that you allow employees to deposit into a single bank accounts. Otherwise, you’ll find yourself managing your employee’s money should you allow them to divide their attention to multiple bank accounts.

Paying employees through direct deposit will permit you to spend less as you don’t need to purchase check inventory. On the flip side, if you make an error in calculating a worker’s pay, it’s far easier to void a payroll check and reissue it. Unfortunately, you can not void a direct deposit payment. Once it’s created, you’ll have to work together with the employee to either issue them a check if you underpaid them reduce the employee’s next direct deposit payment.

If you can not receive every one of your employees to sign up for direct deposit, then you will need to print payroll checks. Printing payroll checks in payroll software such as Gusto is fast and simple. All you need to do is purchase payroll check inventory. The software will even run payroll as an immediate deposit for you.

3. Calculate Paychecks

Now that we’ve covered what you will need to do to prepare yourself to cover employees, the next few sections will cover the actions required to pay workers, listing payroll on the books, and filing and paying payroll taxes.

Before we get into the nitty gritty of calculating paychecks, I do not recommend manually calculating paychecks. To begin with, the calculation can get very complicated, which makes it simple to generate a mistake which requires you to procedure retro pay. Second, any mistake that you make may lead to an under or overpayment to your employee or an under or overpayment to say, national, and local governments. I do not have to tell you miscalculating paychecks will not be an acceptable excuse to provide the IRS if it results in an underpayment of payroll taxes.

Make things easier on yourself by using a payroll software such as Gusto. Simply enter the number of hours worked for each worker, mark any sick or vacation days taken, and Gusto will automatically calculate paychecks for you.

Stop by Gusto

4. Record Payroll

Recording payroll on your books involves making certain that amounts are correctly posted to payroll accounts. Before you can record payroll, you’ll need to set up payroll accounts on your chart of accounts list. The chart of accounts is a listing of accounts that is used to categorize the financial transactions your company creates. To get a general summary of the chart of accounts, check out our bookkeeping manual.

Among many benefits of using Gusto is you can join your QuickBooks accounts to Gusto and map your chart of accounts so that each time you run payroll, each the accounts are updated in real time.

Chart of Accounts Setup

The accounts which you will need to put up to track payroll will generally be an expense account or a liability accounts. An expense is a cost that you have because of performing business like gross wages and health insurance. A liability is money that you owe to other people.

By way of example, workers compensation is a liability because it is money owed to your own insurance provider and worker health insurance is an expense since it’ll be paid to the seller that provides health insurance benefits for your company.

Below is a listing of the reports you’ll generally need to set up on your chart of account to track all payroll-related tasks along with a brief description of every account. Download your free payroll chart of accounts for future reference.

| Account Name | Account Sort |

|---|---|

| Gross Wages | Expense |

| Health Insurance (Employer Share) | Expense |

| 401K Matching | Expense |

| Federal Withholding | Liability |

| FICA Payable | Obligation |

| FUTA Payable | Obligation |

| SUTA Payable | Liability |

| State Disability Payable | Liability |

| Workers Compensation | Liability |

| Employee Health Insurance Payable | Liability |

| 401K Employee Contribution | Obligation |

| Accrued Vacation Payable | Liability |

| Accrued Sick Payable | Obligation |

- Gross Wages — Include the amount that you pay to an employee every pay period prior to any deductions are made.

- Health Insurance — Include the whole quantity of health insurance that you pay to your insurance provider (i.e. Blue Cross, Kaiser, etc.).

- 401K Matching — Should you offer a 401K program to your workers, you may incorporate the number of contributions you’ve made to coincide with your employee contributions within this account. This cash will be paid to the investment company that is responsible for maintaining the business 401K. (i.e. Fidelity)

- Federal Withholding — This account should reflect the entire amount of income taxes you have withheld from all worker paychecks. You will remit these funds to the IRS based the deadlines set by the IRS.

- FICA Payable — Deductions from employee paychecks for Social Security and Medicare taxes will accumulate in this account. You may remit these funds to the IRS based the deadlines determined by the IRS.

- SUTA Payable — This accounts should include the country unemployment taxes that you are responsible for paying.

- State Disability — This account must include the state disability taxes which you have withheld from workers, if appropriate.

- Employees Compensation — In this account, you need to reflect the number of employees compensation due.

- Employee Health Insurance Payable — This account includes the amount withheld from employee paychecks for health insurance coverage. This account will decrease the quantity of health insurance covered by the employer.

- 401K Employee Donation — All worker 401K contributions withheld from paychecks will collect within this account. This money will be paid into the investment company that is responsible for keeping the company 401K. (i.e. Fidelity)

- Accrued Vacation Pay — Should you offer your employees time off with pay, then you need to keep tabs on the amount of time they’ve earned on the books. The way this would work is a worker would earn a certain number of holiday hours each pay period. It’s very important to record accrued vacation because it is money that you owe to the employee. If he/she were to stop or you terminated them then you would have to incorporate all accrued vacation pay in their final paycheck. Let us look at an example to see how this would work.

Example of Recording Payroll

As mentioned in the previous section, a diary entry is best described as the recording of debits and credits. Should you use an accounting software such as QuickBooks, you do not have to enter journal entries often because QuickBooks does this for you”behind the scenes” if you make an invoice for a client or pay a bill. But if you use a manual accounting system, then you will need to create journal entries.

When you record payroll, you will usually debit Gross Wage Expense, credit all of the liability reports, and charge the money account. Gross Wages will appear on your Profit and Loss report, along with the accountability and cash accounts will be included on your Balance Sheet report.

Journal Entry To Record Your $10,000 Payroll

| Debit: Gross Wage Expense | $10,000 |

| Credit: Federal Withholding | $1,000 |

| Credit: FICA Payable | $2,000 |

| Credit: Employee Health Insurance | $1,000 |

| Charge: 401K Employee Contribution | $2,000 |

| Charge: Cash | $4,000 |

Instance of Accrued Vacation

When recording payroll, you’ll also have to account for any accrued vacation. Let’s say a worker receives 10 vacation days annually and is about a biweekly pay period. You would calculate the number of vacation hours that this employee would accrue each pay period as follows:

- 10 holiday days x 8 hours = 80 hours (that is the amount of holiday hours earned each year)

- 80 hours/26 weeks (amount of times a biweekly worker is paid each year) = 3.08 hours (this is actually the number of holiday hours earned each pay period)

To accrue vacation on the books, you must utilize a diary entry. A diary entry is a manual way to document business transactions. It generally will include an effective date, a debit amount, and a credit amount. To find out more about what a diary entry is and how to make one, check this out. Below is a good example of the journal entry we would record for an employee who earns a wage of $30 per hour. ($30.00 occasions 3.08)

Journal Entry to Record Accrued Vacation Pay

| Debit: Gross Wage Expense | $92.40 |

| Credit: Holiday Payable | $92.40 |

Example of Accrued Sick Pay

Very similar to accrued vacation pay, you will also have to keep tabs on the amount of sick pay an employee has earned on the novels. You may establish how much sick pay a worker would earn per pay period (as we did at the above accrued holiday pay example).

Let us assume this employee has got 1 hour of sick pay in a $30 per hour income then our diary entry would be as follows:

Journal Entry to Record Accrued Sick Pay

| Debit: Gross Wage Expenses | $30.00 |

| Credit: Sick Payable | $30.00 |

If you do not wish to manually record a journal entry everytime you run your citizenship, try Gusto payroll software. Gusto easily integrates with QuickBooks and documents all the debits and credits behind the scenes.

Visit Gusto

5. File & Pay Payroll Taxes

There are lots of payroll reporting and record retention requirements at the national, state, and local levels. We’ll concentrate on what the federal government requires. However, in the next section, you’ll discover a few great resources which you can use to research what the prerequisites are for your individual state and local area.

There are four main tax forms that you’re expected to complete so as to report your payroll tax details. Below is a summary table of each tax form, their individual due dates, and a description of the tax reported on each form.

Crucial Payroll Tax Forms & Due Dates

| Tax Type | Due Date |

|---|---|

| IRS Form 941 | 1 month after a quarter ends. (i.e. April 30, July 31, Oct 31 and Jan 31) |

| IRS Form 940 | Annually on Jan 31 for the preceding tax year |

| IRS Form W-2 | Must be filed electronically using the SSA (Social Security Administration) workplace by Jan 31 for the previous year.

Has to be mailed to employee no later than Jan 31 for the previous tax year. |

| IRS Form W-3 | has to be filed electronically using the SSA (Social Security Administration) workplace by Jan 31 for the preceding year. |

IRS Form 941

Use this form to report the total Social Security and Medicare taxes (FICA) withheld from all employee paychecks in addition to the employer share of Social Security and Medicare tax. Social safety is 12.4percent of employee salary up to a maximum salary of $127,200 (2017) and $128,400 (2018). Medicare is 2.9percent with no salary cap.

While you have to file Form 941 on a quarterly basis, you could have to submit payments to the IRS either on a monthly or semimonthly basis. Check our FICA & Form 941 tax guide to learn when to pay FICA taxes and file Form 941.

IRS Form 940

Under the Federal Unemployment Tax Act (FUTA), employers need to pay a tax rate of 6% on the first $7,000 that each worker earns. Form 940 has to be submitted yearly to report payments made for unemployment taxes. While you simply have to submit this form annually, you may be required to submit payments more frequently than that. For more information, head over to our FUTA tax manual.

IRS Form W2

The W2 form provides workers with a summary of the salary that you paid them as well as the deductions taken for the tax year. You must supply all workers with this form by Jan 31. You also need to file this form with the SSA (Social Security Administration). It is recommended that you file this type. Check out how to file electronically to discover more.

IRS Form W3

This form is a summary of W2 forms issued to employees, you should also file this form with the SSA and W2 forms. This form should be submitted electronically with the SSA at the same time that you file type W2.

Manually Calculate Payroll Checks

For the great majority of small business owners, outsourcing payroll to payroll software company like Gusto will be a huge time saver for calculating paychecks. But, I do believe it is essential for you to know what goes on calculating payroll checks in the event you ever need to do it manually or to fix a payroll error.

Let us walk through the parts of the formulation then use an example so that you can see how to do the calculation. Here’s the formula to calculate net pay for an employee along with a brief description of each element:

Net Pay = Employee Gross Pay — (Employee Share of Social Security + Medicare + Federal Withholding Tax + Other Deductions)

Gross cover

Gross pay is your salary/wage paid for an employee each pay period. The formula to compute gross pay for hourly and salary employees is as follows:

- Hourly employee: Hours worked x Hourly Rate

- Salary employee: Annual salary/Total # of pay periods

Social Security Tax

As an employer, you are required to withhold 6.2percent of a worker’s gross pay for Social Security. You’re also required to match the 6.2% employee contribution. Here is the formula to calculate the worker’s share of Social Security taxes:

- Gross cover x 0.062

Medicare Tax

You are required to subtract 1.45% of an employee’s gross pay for your Medicare fund. Very similar to Social Security, you must match exactly the 1.45% employee participation. Here is the formula to calculate the worker’s share of Medicare taxes:

- Gross pay x 0.0145

Federal Withholding

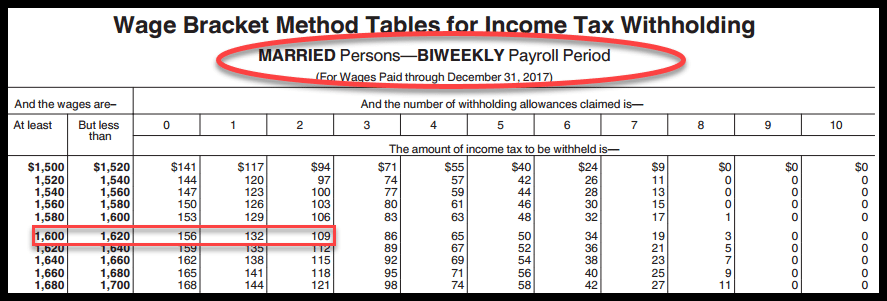

Federal withholding is the amount of income tax which a worker must pay, based on their gross pay, tax bracket, the amount of allowances claimed on Form W-4, and their marital status. With this advice, you may look up the national withholding amount for employees using the IRS Tables in Pub 15.

To determine how this works, let us walk through an example:

Federal Withholding Example

In this example, let’s assume our employee is married and has maintained 2 incisions onto her W4 form. She’s paid $1,600 per pay period. Assuming we run payroll on a biweekly basis, we’d use the following wage bracket table (out of IRS Pub 15) to determine the amount of income tax to do. Based on this table, we would withhold $109 from the employee’s paycheck for income tax.

Additional Deductions

Based on what fringe benefits you offer, there may be several deductions you need to make for employee paychecks besides Social Security, Medicare, and federal withholding. By way of instance, if you provide a health insurance plan that the employee can contribute to, then you will have to deduct the employee’s share of the health insurance policy in order to compute net pay.

Putting It Together

Now that you are more acquainted with the components of calculating net pay to your workers, let us walk through an example. We will assume that the worker makes $20/hr and worked 80 hours this pay period.

Here are the 6 steps to calculate net pay for an employee paycheck:

Calculate Internet Pay for Employee Example

| 1. Calculate Gross Rewards | 80 hours X $20 = 1600 |

| 2. Calculate Federal Income Tax Withholding (from previous example) |

$109 |

| 3. Calculate Social Security Tax | $1,600 X 0.062 (6.2%) = $99.20 |

| 4. Compute Medicare Tax | $1,600 X 0.0145 = 23.20 |

| 5. Subtotal all deductions (steps 2, 3, 4) |

$109 + $99.20 + $23.20 = $231.40 |

| 6. Subtract subtotal of all deductions from Gross Pay to get Internet Pay | $1,600 – $231.40 = $1,368.60 (Net Pay) |

State and Local Requirements

In this guide, we’ve primarily focused in your tax obligation at the federal level. However, states and localities may have additional or different laws when it comes to payroll taxes. To find out more about your tax responsibility at the state level, consult your state tax site.

The Bottom Line — The Way to Do Payroll Accounting

If you are somewhat overwhelmed by the intricacies of studying the way to do payroll accounting, you’re not alone. Gusto can save you a ton of time by automating manual tasks such as calculating your own paychecks and calculating your share of Social Security tax, Medicare tax, and federal and state unemployment taxes.

Visit Gusto