A Professional Employer Organization (PEO) is a co-employment alternate for small businesses that are looking to offer specialist human resources (HR) and employee benefits choices similar to larger companies. PEOs are best for small businesses looking for advantages such as low cost health insurance at group rates because of their purchasing power.

We’ll explain how PEOs operate, what they cost, and also how to combine . If you need help choosing a PEO, think about working with a broker, like The Huldisch Group, that can match you with a PEO service according to your location, industry, and HR, benefits, and payroll needs.

Stop by The Huldisch Group

The best way to PEO Works

PEOs vary from other HR outsourcing companies because they become co-employers of your workers. In other words, while you run and manage your day-to-day business, your workers have two employers — you as their direct supervisor and the PEO for legally-compliant HR, benefits, and payroll processing.

Firms are usually pooled together in a PEO supplying the PEO leverage to negotiate far better prices on medical insurance. PEOs have established partnerships with large insurance companies, which also helps them negotiate more and better benefit plans and solutions. Therefore PEOs can provide a large array of services at fair rates, from commuter benefits to 401k plans.

Typically, they supply:

- HR, benefits, and payroll processing

- New hire paperwork and employee onboarding

- Compliance with state and federal employment law

- ACA-compliant health insurance plans at group rates

- Retirement savings plans such as 401k

- Workers reimbursement

- Labour law posters

- Terminations and offboarding

- Some PEOs Provide time keeping and employee scheduling tools

- Some PEOs can also manage recruiting and coaching

A PEO is a Co-Employer

Co-employment is when both associations (your small business and the PEO) share the legal responsibility for the employees. For regular business decisions, such as promotion, customer service, or directing that which job has done, you keep full control. But, whatever may raise HR-related legal problems, like security, labor-law compliance, or worker discrimination is the point where the PEO will standardize processes for you.

As a co-employer, the PEO ensures your company is installed in compliance with state and federal labor laws and uses HR best practices. That’s to your advantage, helping you along with the PEO avoid risk. By way of example, 1 PEO customer found after connecting the PEO that they’d need to receive their payroll out of arrears since the PEO said it created liability and was not a best practice. To be able to join the PEO, the organization had to solve that issue.

A PEO Has Buying Power

Since PEOs work as co-employers to potentially hundreds of different companies, they are able to negotiate group rates which save you money when providing worker benefits in multiple states. They can offer health insurance, life insurance, disability, workers compensation, 401k plans, and other benefits, like commuter benefits, at greater rates by pooling your workers with others in similar sectors.

A PEO Offers Legally-Compliant HR Services

PEO companies provide more than just back-office paperwork processing for HR and payroll. They’re licensed in HR and have the resources and experience to maximize worker effectiveness while reducing risk. They understand HR law, and their strategies are designed with tax tables and labour law tools so that they help you avoid legal mistakes or penalties.

As a co-employer, a PEO works with you, very similar to having your own HR, benefits, and payroll department. The services a PEO provides are much like a full-time HR professional would provide to your business in terms of HR consulting, onboarding, benefits enrollment, payroll processing, keeping the employee handbook, and managing terminations.

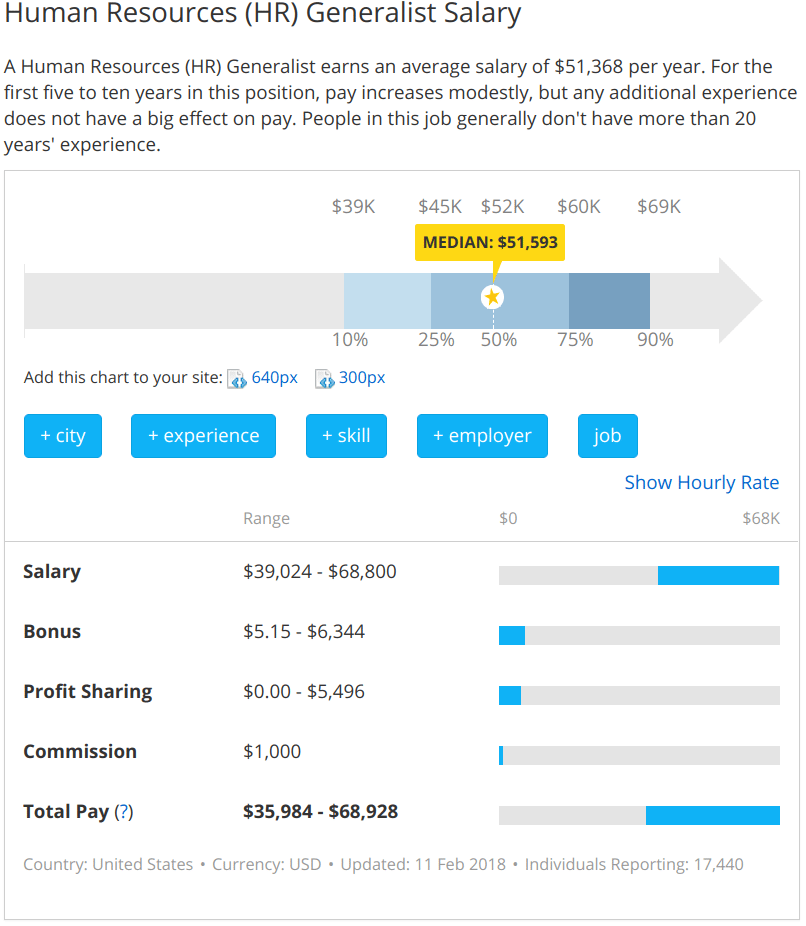

However, the price of a PEO is much lower than hiring a complete time HR person. In fact, based on PayScale, including an HR generalist to your own team would cost a little over $51,000 per year and you’d still have to pay for office space and software, in addition to any benefits, such as paid time off.

HR Generalist salary vary based on PayScale

What PEOs Price

PEOs bill a percentage of every employee’s salary or a flat rate per employee. Joining a PEO can begin as low as $49 per employee per month with a seller like Justworks, whereas a PEO vendor like Trinet may cost $125 per month. PEO membership fees depend largely on the average compensation of your workers and other factors, like the service offerings which we will review below.

PEO prices move up depending on the service offerings you choose, whether or not you choose to offer or contribute to worker benefits, the number of employees you have, and whether self-service options are provided to your employees. In addition, if your employees are largely midsize you may pay as low as 2% of salary. If they are wage workers, you are going to pay closer to 6%.

If you’re looking for a PEO that handles training and recruiting along with gains, expect to pay a higher percentage or rate. PEOs with much more comprehensive services can charge around 11% of payroll, making them somewhat costly for the typical small business owner.

Additionally, some PEOs, such as ADP TotalSource, cost according to your own business’ credit score, your hazard level (for employee’s compensation), along with your health advantages history. Based on those factors one company may pay twice what another employer pays for the same services.

For more information, read the whole post comparing PEOs and/or have a peek at all our PEO provider reviews.

Should you need help to choose that PEO is right for your organization, you can reach out into The Huldisch Group for a free consultation. They’ll connect you to the very best provider for your small business according to your industry and size.

Stop by The Huldisch Group

Where to Find a PEO

If it comes to PEO providers, the options can be overpowering. We’ve got reviews of many PEO businesses, along with pricing. The National Association of PEOs (NAPEO) also has valuable tools for choosing a PEO, as well as a search tool to find a PEO on your own state. And sellers like PEOCompare allow you to perform a completely free PEO search by picking out the specific services that you want.

Our PEO buyer’s guide provides pricing and information comparing the top PEOs for small business. We’ll provide a glance at three distinct PEOs for comparison.

Justworks

Justworks is one of the newer PEOs and functions as an entry-level HR outsourcing company with HR, benefits and payroll services for companies with as few as 2 employees as well as 100 or more. Their prices start as low as $49 per employee per month for basic service with no employee benefits. Read our Justworks User Reviews and Pricing Guide to Learn More.

Trinet

Trinet is a recognized PEO with tens of thousands of business customers and gives outstanding benefits in all US locations, including small communities. It’s great for multi-state companies with 10 or more employees with pricing between $125-$155 per worker per month based on variables like location and ratio of midsize hourly staff. View our Trinet User Reviews and Pricing Guide.

ADP TotalSource

ADP TotalSource is ADP’s PEO offering and makes sense for people already using ADP that want to upgrade to a PEO. ADPs pricing is based on several factors that include your company credit score and benefits expertise, so you’ll want to get them directly to get a quotation. Read our ADP TotalSource Reviews and Pricing Guide for more information.

You could also use a broker like the Huldisch Group to get an expert opinion on which PEO would best match your business based on industry, size and characteristics needed. Their support is completely free to you, so click here to get in touch with a representative.

Visit The Huldisch Group

How to Join a PEO

To join a PEO, you will probably have to go through an application process where the PEO assesses the accountability of your company to make sure they want to associate with you as a co-employer. The process of joining a PEO usually takes between three to fourteen days. There are a few qualifiers they will look for:

- The financial and credit situation of Your Company, such as your business credit score

- Whether you’ve had some workers compensation claims previously (if you operate in a higher risk environment you’ll likely be charged a greater workers comp rate)

- The percent of employees likely to participate in benefits, and some benefits usage trends

As a co-employer that the PEO will also require access to information about your workers. Expect to show them I-9s, W-4s, and W-9s for all your workers, as well as every other demographic and identifying data needed, such as the age of your employees, whether they are hourly or salaried, and what states they operate in.

3 Tips When Selecting a Professional Employer Organization

Here are a Couple of tips to keep in mind when Picking a PEO to combine:

- Confirm that the PEO is certified by the IRS or ESAC, the Employer Services Assurance Corporation

- Contemplate a PEO that specializes in your industry, especially if you are subject to industry-specific regulations, like OSHA safety, DOT drug testing, or financial-services licensing

- Make sure your PEO will cover the activities you want to outsource like citizenship, although not those you need to keep doing your self, like applicant tracking or worker training

3 Benefits of Working with a PEO

Benefits of working with a PEO comprise HR legal compliance, which can be important as your company grows or you hire employees in multiple countries. A PEO’s buying power leads to good medical insurance rates for you and your staff. But the most significant advantage might be helping you escape the trunk so you can focus on your core business.

Whether a PEO is Ideal for your company depends mostly on these 3 variables:

PEOs Help You Handle More Employees as You Grow Larger

Generally, having more than 10 but fewer than 100 employees could signify a PEO makes sense for your company. The explanation is that if you don’t have lots of employees, you are probably able to manage HR jobs yourself without a lot of strain, or you’ll be able to add those tasks to an present office manager or bookkeeper’s workload.

On the other hand, in case you have a lot of employees, it’s probably cheaper to outsource your HR works to a company such as a PEO, since you’ll likely start encountering issues like maternity leave asks, training or even discipline problems, that you’ll want to do right. You might even want to record policies or create an employee handbook to prepare for business growth. 1 HR consultant reminds us:

Jill Santopietro, Creator, 21Oak HR Consulting, LLC

“When you have even 1 employee, you could begin having employee issues”.

She notes that even family companies who frequently use the term,”we’re a family” as code to mean they haven’t yet established policies and processes, frequently encounter HR issues, like”how do I shoot my uncle or sister-in-laws child?”

PEOs are going to keep you compliant with federal and state employment laws and manage things like proper judgment documentation and worker’s compensation claims and audits.

PEO Benefits Can Help You Attract & Retain Staff

PEO benefits generally include a vast selection of options like health, dental, and vision, 401K plans, life insurance, and much more. These benefits are administered by the PEO. This may be particularly useful if you have your company in a place like Chicago or Los Angeles, where providing rewards may otherwise be cost prohibitive.

You can find out more about the choices for providing benefits and how to compare costs in our full manual on the best way best to provide benefits, but this is surely an area where a PEO can be helpful because they have more choices and much better prices than you could negotiate on your own. Our own research shows that health benefits are one of the highest perks employees need.

Fit Small Business is part of a PEO for these reasons. Our PEO, Trinet, manages a vast variety of benefits that our employees enjoy — health insurance, payroll, compliance, and much more — such as self service options that let workers seem up their own information online, such as on health insurance expenses and FSA balances. Here Is What PEO expert Mark Sokol states:

Mark Sokol, Creator, PEOCompare

“Having worked with and for a PEO — I’m sold on the advantages of’getting you back to your own company’ since the PEO’s company is’employment’ responsibilities. I have seen each PEO which I worked with (and one PEO I worked in the past) bring HR professionalism into the small organization. Allowing us to compete for gift — that was hard at that software company so many years back. It continues to be a viable choice. “

A PEO Reduces Your Administrative Workload & Risk

A PEO can deal with the HR administrative tasks such as onboarding, offboarding, providing an organizational chart, administering health benefits, payroll, and paid time off. This decreases the workload on your own end and takes some HR and labour law liability your shoulders off.

Again, if you’re able to do these things yourself without too much trouble, then you likely don’t need a PEO, but if you end up spending 5-10 hours a week or even more on HR jobs, or racking up payroll or labour law penalties, it may be worth it to work with a PEO.

Drawbacks of Using a PEO

The key drawbacks of using a PEO include possible loss of health benefits tax savings, a realization that you’re not completely free of all HR paperwork, or concerns which you are no longer able to manage your own employees. Let us look at each of them to help you consider the disadvantages relative to the benefits above.

You May Feel a Loss of Control Regarding Employee Management

When you join a PEO, you and the PEO become co-employers. To be able to fire or hire somebody, or create any HR-related alterations, you need to consult the PEO. This is sometimes a good thing, since you’re essentially getting a spouse who’s professionally trained and may block you from making legal mistakes.

However, it can also slow you down and requires full control over the way you manage your staff. As with any business partner, you would like to have a fantastic working relationship with all the PEO staff, and also a high level of trust. You’ll also want to be certain the PEO can respond to your concerns on short notice.

You Will Not Remove All Back Office HR Busywork

A frequent criticism from business owners is that they have active work after employing a PEO. Despite the PEO tackling HR tasks, managers had to send in paperwork and serve as a link between employees and the PEO. Of course, even when you hired a full time HR person, managers are expected to help with employee monitoring, and conducting performance reviews, as examples.

A PEO can’t interview final candidates, manage employee feedback or process weekly time cards. That work belongs to you and your managers. The quantity of work you have to do, though, will depend heavily on the PEO you select and also the service level provided. For example, PEOs offering employee self-service options let workers update download or benefits paystubs by themselves, saving you from being the go-to individual for all these requests.

You Could Reduce Health Benefit Tax Savings

Should you combine a PEO, you won’t probably choose health insurance in the government-run SHOP Exchange, as you will have to choose the PEO’s insurance providers.

You will therefore miss out on obtaining any tax credits you might have received if you were to purchase insurance through the SHOP Exchange. Nonetheless, in many cases, the advantages available through the PEO are cheaper. Ultimately you want to do your own cost comparison to weigh the administrative and premium costs saved by outsourcing into the lost tax advantages.

Consider working with a broker, like the Huldisch Group to help you weigh the pros and cons.

Stop by The Huldisch Group

The Way PEOs and Their Software Have Evolved

We chatted Sokol, quoted above, as he conducts a site which contrasts PEO services. He shared insights with us on how PEOs have evolved:

“PEOs have evolved in their software and are currently a platform on which to scale your company, by offering employee self-service, and easy-to-use apps. PEOs also save you from needing to buy, implement and manage data on multiple HR, benefits, timekeeping and accounting systems.

And if you have employees in more than 1 state, that complicates your payroll and tax processing. Some companies attempt to work around this by hiring 1099 builders instead. Whereas a PEO enables you to expand into other states and employ the best talent nationwide.

Furthermore, PEOs offer HR consulting so that you don’t have to employ your own HR manager. Even if you have as few as 10-15 workers, a PEO makes it possible to avoid expensive employment mistakes and reduce labour law and citizenship dangers.”

Good Alternatives to a PEO

If you would like to offer the benefits a PEO provides, without the state of co-employment, then you may be interested in a few of the newer HR outsourced support providers. They provide HR, benefits, and payroll as a cloud-based software or service.

However, using a service or software, you’ll most likely be giving up other benefits that a PEO provides. You may need to pay for each service separately — such as garnishments, or rewards enrollment training — that can get costly. And the majority of the companies below do not have the purchasing power that PEOs have.

Additionally, you’ll be more liable for dangers like verifying an applicant’s job history or handling sexual harassment claims. And if you have a payroll issue, it’s likely to be on you to resolve. In the event the legislation around employees compensation, by way of example, change, no one is going to be advising you on how to comply with new demands like a PEO would.

Tanya Bourque, Co-Founder, Untappt

“My experience with PEOs hasn’t been the best. 1 customer with 15 workers was quoted a cost of $16,000 a year, which didn’t consist of fundamental features like recruitment, which would have been an upcharge. I’ve discovered a small company will often save up to 75% in prices if they build out their particular systems. For instance a company with fewer than 10 employees may use Gusto for HR, payroll and benefits and then use BreezyHR for applicant tracking. Or an organization which plans to grow rapidly, may consider BambooHR using BreezyHR, then hire a part time contract HR consultant to assist them in setting everything up.”

Bourque proposes an east-coast based HR consultant might charge between $100 to $150 an hour, or provide a new business start up package to provide everything from generation of company policies, a employee handbook and systems set up. A one-time HR consulting start-up bundle might cost between $5,000 to $12,000 depending on how much help the company should execute, and would save you from paying high PEO rates in the long run.

3 PEO Alternatives With Similar HR, Benefits & Payroll Features

There are several choices to PEOs offering tiered services to supply you with the degree of HR, payroll, or benefits management which you require. PEOs, in contrast, provide flexibility. Consider software programs like Gusto, BambooHR, or Zenefits that offer HR, benefits, and payroll with no co-employment devotion:

Gusto Payroll

Gusto is also a great alternative to your PEO. Like BambooHR and Zenefits, Gusto doesn’t become a co-employer of your employees, so you stay in control. They currently provide affordable group benefits in 19 countries, onboarding, and even HR consulting along with their citizenship and compliance services. Read our Gusto review and Gusto comparisons to find out more.

BambooHR

BambooHR does payroll, compliance, PTO tracking, and provides recruiting and performance management applications to its providers. However, while you can link medical insurance and other benefits like life insurance via BambooHR, it doesn’t have Gusto’s purchasing power. Have a look at our BambooHR review and BambooHR comparisons.

Zenefits Gains

Zenefits is an excellent alternative to using a PEO. Like Gusto and BambooHR, Zenefits offers a platform for managing and administering HR, including payroll, medical insurance, time and holiday tracking, retirement plans, and a lot more in 1 place. You can use your current service providers or they can hook you up with their vendors. View our Zenefits review and Zenefits alternatives articles.

The Bottom Line

A PEO can be a terrific alternative for a small business owner who’s prepared to pay for peace of mind, reliable HR / payroll solutions, and wishes to supply a vast assortment of benefits to their employees. We at Fit Small Business believe the advantages of working with a PEO outweigh the costs, which is why we use ourselves it helps to attract and retain better talent.

However, you have to be prepared and willing to let the PEO into your company as a co-employment spouse. They will require access to your financials, your small business credit history, and your team’s information as part of the deal. That’s why we advise that you work with a PEO broker, such as Huldisch. Their expertise can help you navigate the very best PEO option for your industry.

Visit The Huldisch Group