Purchase order funding (PO financing) is an improvement from a financing institution that pays your suppliers for merchandise you are reselling or distributing to a customer who has completed a written purchase order. You can fund up to 100 percent of this purchase order costs with typical rates falling between 1.8% and 6% each month.

Purchase order financing typically takes 1-2 weeks to finance. If you need a solution quicker than this, you might wish to consider a short-term small business loan. Short-term lenders have simple online application procedures and higher acceptance rates compared to traditional small business loans. Additionally, they can normally have you funded in 1 day. Check out our review of the rates, terms, and qualifications .

Best Short-Term Lenders

What Purchase Order Financing Can Be

Purchase order funding aids businesses that need money to meet product orders by paying your provider for the manufacturing and transport of products up front, until you receive payment from your customers.The funds can’t be used for anything aside from the purchase of particular goods needed to fulfill your customer’s order.

In order to be eligible for purchase order funding you must sell finished products (not raw materials or product components) to B2B or B2G customers with profit margins of 15%+. Startups can qualify, but the majority of your program depends on the creditworthiness of, and your previous history , your suppliers and customers. It can be easy to qualify for if your client and supplier in the trade are equally well established and respectable businesses.

PO funding is a great way to help your organization grow without needing bank debt or selling equity in your company. If earnings outpace your incoming cash flow afterward buy order funding may be a good match to fulfill a new customer order.

Purchase order funding is funding you get before you have delivered good to your clients, and before you have invoiced them. If you’ve already delivered products or services to a B2B or B2G customer and invoiced that client, invoice factoring is the ideal option, not PO financing.

Who Makes PO Financing & When?

There are many conditions where buy order funding may be perfect for your company. Each is centered around the need for money to make purchases from suppliers that you can’t manage, but need in order to fulfill a customer’s order. Companies that use purchase order funding include:

- Distributors

- Wholesalers

- Resellers

- Importers or Exporters of Finished Goods

- Outsourced Manufacturers

Purchase order funding can help you with various scenarios that include:

- Seasonal Sales Spikes: At the beginning of a seasonal earnings spike you will receive purchase orders that exceed your existing working capital.

- Substantial Growth: If your earnings growth is outpacing existing small business lines of credit due to increase then you may be a good candidate for PO funding.

- Consistently Tight Cash Flow: Most small businesses have consistent cash flow issues at specific points of this month on a constant basis.

This isn’t an all-inclusive list of when purchase order funding may work, but instead are some of the most typical reasons it is chosen as a funding alternative. A number of these situations may also be solved by using a small business line of credit through a loan provider like Kabbage.

A business LOC can be equally as easy to qualify for purchase order financing, however you can get funded quicker. Kabbage can prequalify you in minutes for up to $100K in financing and you may receive your funds as quick as 1 day.

Stop by Kabbage

The Way Purchase Order Financing Works

Purchase order financing entails a minimum of four different parties who can complicate it at various points in the procedure. These parties are:

- The borrower: That is the one seeking funding.

- The PO financing company: That is the company providing the financing.

- The supplier: Here is the company that provides the goods which the borrower resells or distributes.

- The customer: This really is actually the debtor’s client who they sell to directly.

Each party involved can make it harder for you to finish the financing process, and may stop you from keeping your costs down. By way of example, if your providers are slow to manufacture products then you might be paying extra to the duration of time that it requires them to provide the merchandise. And if you’ve guaranteed your customers terms in their obligations then you could be taking a look at additional costs as well because the longer it takes for the funding company to be compensated the more expensive your loan receives.

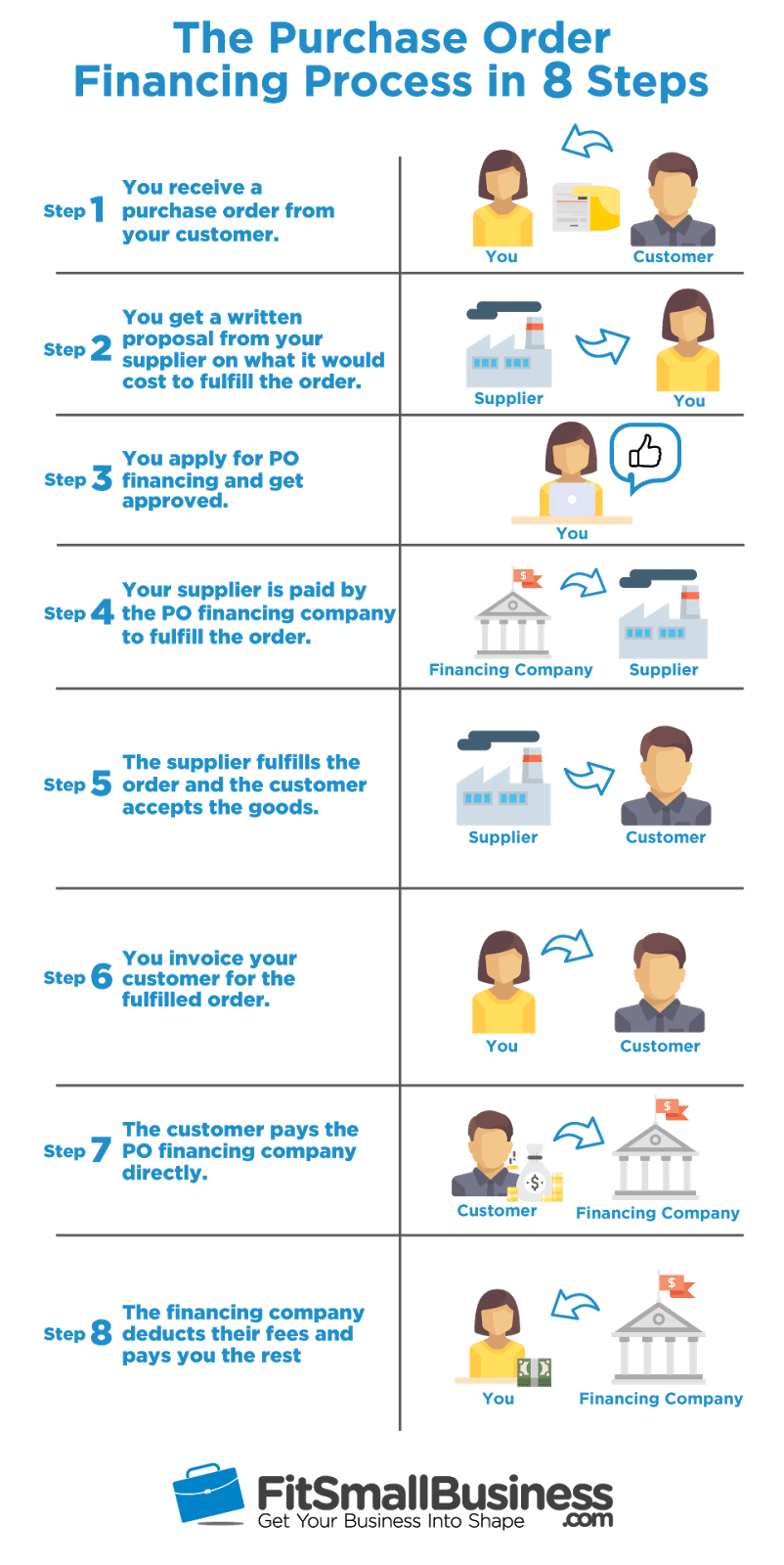

While all this may seem confusing initially, it can easily be understood if you break it down step by step. Here are the 8 steps to purchase order financing:

Step 1: The borrower receives a huge purchase order in their customer.

Step 2: The client gets a written proposal from their provider on what it would cost to purchase the goods required to fulfill the customer’s order. At this point, if the client does not have the available funds necessary to satisfy the purchase they then seek out financing.

Step 3: The borrower finds the ideal PO financing company, applies for the financing they need, and has approved. To be able to apply you will have to provide both the customer’s purchase order and the provider’s proposal.

Measure 4: Once the borrower is approved, the PO financing company pays the supplier, via a letter of credit, to manufacture and deliver the merchandise required to meet the purchase order.

Step 5: The supplier delivers the goods to the customer directly, or delivers them directly to the borrower if they have another shipping method they want. When the client receives the merchandise they must accept the purchase.

Step 6: The debtor invoices their customer for the merchandise and either demands immediate payment or gives them internet terms. The longer it takes to get payment from the customer, the costlier the funding becomes.

Measure 7: The customer pays the PO financing company right for the full price on the borrower’s invoice.

Step 8: The PO financing company deducts their charges from the funds and then pays the remaining balance into the borrower.

PO Financing Rates, Terms, & Qualifications

The table below reflects typical terms and qualification requirements you’re likely to see from a purchase order funding company.

Purchase Order Financing Conditions & Qualifications in a

| Amount Financed | Up to 100 percent of the cost of goods to fulfill your customer purchase order |

| Time For Provider to Be Paid | 1-2 Weeks |

| Repayment Terms | 60 Days or less |

| Cost | 1.8% – 6% per month |

| Qualification Requirements |

|

If you don’t qualify for purchase order financing, there are numerous other financing options that can better fit your requirements.

General Terms of PO Financing

With purchase order financing you’ll be able to finance up to 100 percent of the total price of goods required to meet a written customer order. Typically the application process is easy for the borrower. All you have to present the financing organization is a buy order submitted by your client and documentation of the costs you would owe your provider to meet this order. The purchase order will need to detail a particular number of goods to be purchased and a particular cost the customer is paying for those products.

Each PO financing company will have their own minimum profit margin qualifications, but start at 15 percent or more. You may expect the whole process to last about 1-2 weeks before your supplier is paid. Your provider is paid through either a letter of credit guaranteeing payment for the merchandise (most common), or with a direct cash payment.

You ought to think about the time it will take your provider to manufacture or supply the goods you need after they’ve received their payment. This could increase the timeframe where your client will obtain the goods.

Purchase Order Financing Prices

Purchase order funding is an expensive short term financing option. The fees vary based on the volume and risk of the transaction to the financing company. Most purchase order funding companies we have reviewed charge a percentage of the financed amount for the initial 30 days in repayment. Then they charge another amount afterwards that varies on cost and the amount of days until it’s charged again. The prices vary appreciably from 1.8% to 6 percent per month.

The costs after the month aren’t made as apparent by individual financing businesses, but the industry average for these additional costs are approximately 1.25percent each week. In accordance with Commercial Capital, a purchase order financing company, the next cost examples are typical if you’re approved for a 3% financing speed:

| First 30 Days | Following First 30 Days | |

|---|---|---|

| Model 1 | 0.03 | 1 percent per 10 days |

| Model 2 | 0.03 | 0.1hours daily |

| Model 3 | 2% for 20 days, then 1 percent per 10 days | 1 percent per 10 days |

You’ll see that all of these choices have a similar price for a 30 or 60 day duration, but are broken up differently depending on when your customer pays. Obviously the faster your client pays your bill (in most circumstances, after delivery or after ) the less costly purchase order funding becomes.

The loan term starts when your supplier is provided the funds. This makes it a really expensive option if your supplier is slow to deliver or deliver goods, or if you’ve promised your customer payment terms longer than 30 days. Both these things can greatly impact how much PO funding will cost to your business.

The table below shows an example of what purchase order financing could cost you. We suppose the loan in the table is paid by your customer in just 50 days, and that you qualified for a 3 percent rate of interest.

Purchase Order Financing Cost Example

| Loan Number | $100,000 |

| 1st Month Cost | $3,000 (3%) |

| 2nd Month Price | $2,000 (1 percent per 10 times ) |

| APR | 0.365 |

| Total Cost | $5,000 |

These prices are comparable to other alternative business loans, even if paid back at precisely the exact same time period. One example is a short-term business loan which has a entire APR as low as 30% for a term loan of up to 3 decades.

Purchase Order Financing Qualifications

It is rather simple to qualify for purchase order financing provided that you cope with established, reputable clients and suppliers. Even newer businesses can qualify if you’ve got verifiable industry experience.

The most important qualifications are that you are a B2B or B2G company that sells concrete products with a minimum of 15% profit margins. And your provider and client involved in the transaction are creditworthy.

Gain margin is the one requirement that changes the most between financing businesses. We have seen the minimum requirement as large as 25%, but generally it’s set at 15% or 20 percent. The profit margins are calculated per transaction by using your customer’s written purchase order along with your supplier’s written statement.

The exact significance of having creditworthy customers fluctuates and depends on the loan provider you select. Many loan providers will complete a commercial credit rating of your customers through shared credit bureaus like Dun and Bradstreet. At minimum, your customers and providers should have the following credentials:

- Trend of timely payments

- No recent bankruptcy

- No serious litigation history

Where to Purchase Purchase Order Financing

There aren’t a lot of funding companies which only concentrate on purchase order financing, in addition to a limited number that we’re able to discover that even advertise it as a commodity. Many banks and financing companies that offer accounts receivable funding solutions may offer PO funding without publicly advertising it. In case you’ve got a prior relationship with these institutions then we’d recommend discussing what PO financing opportunities they might have the ability to offer you.

There are generally two types of financing institutions that offer purchase order financing:

- Banks: Traditional banks don’t commonly advertise PO financing, but a lot of them will provide it as an add-on funding for longstanding clients. In case you’ve got a previous positive banking relationship then you might choose to initiate the process of locating a loan provider by checking with them first. It is likely that you would be able to get the best rate options for PO funding from a financial institution you have a prior financial relationship with.

- Loan Providers: There are additional financing institutions that concentrate on AR financing or other lending solutions that will offer PO financing. These are primarily online lenders with varying degrees.

If you’d like to learn more about the top order financing funding firms we have reviewed you can read our purchase order financing buyer’s guide.

Things to Search For in a Purchase Order Financing Company

If you’re looking for the right PO financing spouse then you’re likely to want to learn some specific facts about the lender’s background in PO finances, and exactly what their typical costs look like. To Assist You make the Ideal loan provider choice, here are some questions you can ask potential suppliers before agreeing to work together:

- How many transactions have they managed in your industry?

- How long have they been in business?

- What loan products do they offer? If PO funding is just one of several products, do they have a team of specialists that only work on buy order financing?

- How can they pay suppliers and when? Is it through a letter of credit or through cash? Can they pay upfront or after the client pays?

- What are their typical costs and what is the breakdown of these costs?

- What type of background or credit check do they work on your customers or suppliers?

- How can they receive payment from your customers?

- Do they have any communication directly with your customers?

The replies to these questions will give you a clearer idea of whether the merchandise provided by any potential purchase order financing business will work with your business’s needs.

Bottom Line

Purchase order funding is a great source of funding if your sales growth is outpacing your cash flow, but it could be costly. It makes it possible for you to take on additional customer requests as you wait to get payment for past jobs. To find the very best rates we suggest you’ve margins above 20% and have a very long history with your customers and suppliers.

We do not recommend purchase order financing unless you have exhausted other financing options . If you’re a prime debtor then you will have tons of alternatives available to you that will be less expensive than PO funding.

An alternate solution is getting a loan by a short-term lender. With a quick online application process and minimal paperwork, a short-term lender makes getting a business loan simpler. But who is best? Check out our review of charges, terms, and qualifications.

Greatest Short-Term Lenders